Bitget Annual Briefing 2022-23 : The Rational Path Ahead (Part 1)

A guide on how to embrace the year of 2023

A Summary Of 2022 First Month Into 2023

Many entered into 2022 with lots of expectations; the wave of ‘Bitcoin 68K’ exuberance had yet to subside, the total market cap was recorded at US$2,310,406,051,487 on New Year, only to tumble hard and fast as Bitcoin lost its momentum and shed 11% within 24 hours on January 22, 2022.

At Q1 2022’s lowest (it sure seems like the bad omen we couldn’t escape from), the total market cap saw a 29% decline from the year’s high. Volatility is supposed to be higher in crypto, yes; but we didn’t see any of the Ronin hack, the Terra collapse or the FTX bankruptcy coming, one after another right when the market showed signs of recovery.

Mainstream interest in crypto, therefore, dropped by half. However, ‘Metaverse’ and ‘NFT’ remain in the top crypto-related search terms, being on par with ‘Crypto’, despite a great deal of persisting skepticism. Meanwhile, Bitcoin reaffirmed its value as the flagship cryptocurrency - the number of searches for ‘Bitcoin’ shot up during the most challenging periods (May and November 2022) - leaving stablecoin (‘USDT’) way behind.

If 2022 is the year to forget, 2023 indeed greeted us with open arms: as of February 10, 2023, the global market cap stands at US$1,060,566,159,246, up by 28% from January 01. Yet it’s important to note that the crypto market has reclaimed the 1T mark already after the first 15 days of the new year - a much better start compared to that of 2022.

The year-to-date (YTD) returns of the top 10 cryptocurrencies in 2022 and 2023 is shown in the chart below.

Amid prolonged scrutiny (due to its close ties with FTX and the notorious Sam-Bankman Fried), Solana (SOL) turned out to be the best performer with 105% in YTD returns, followed by Polygon (MATIC) at 62% and Cardano (ADA) at 47%.

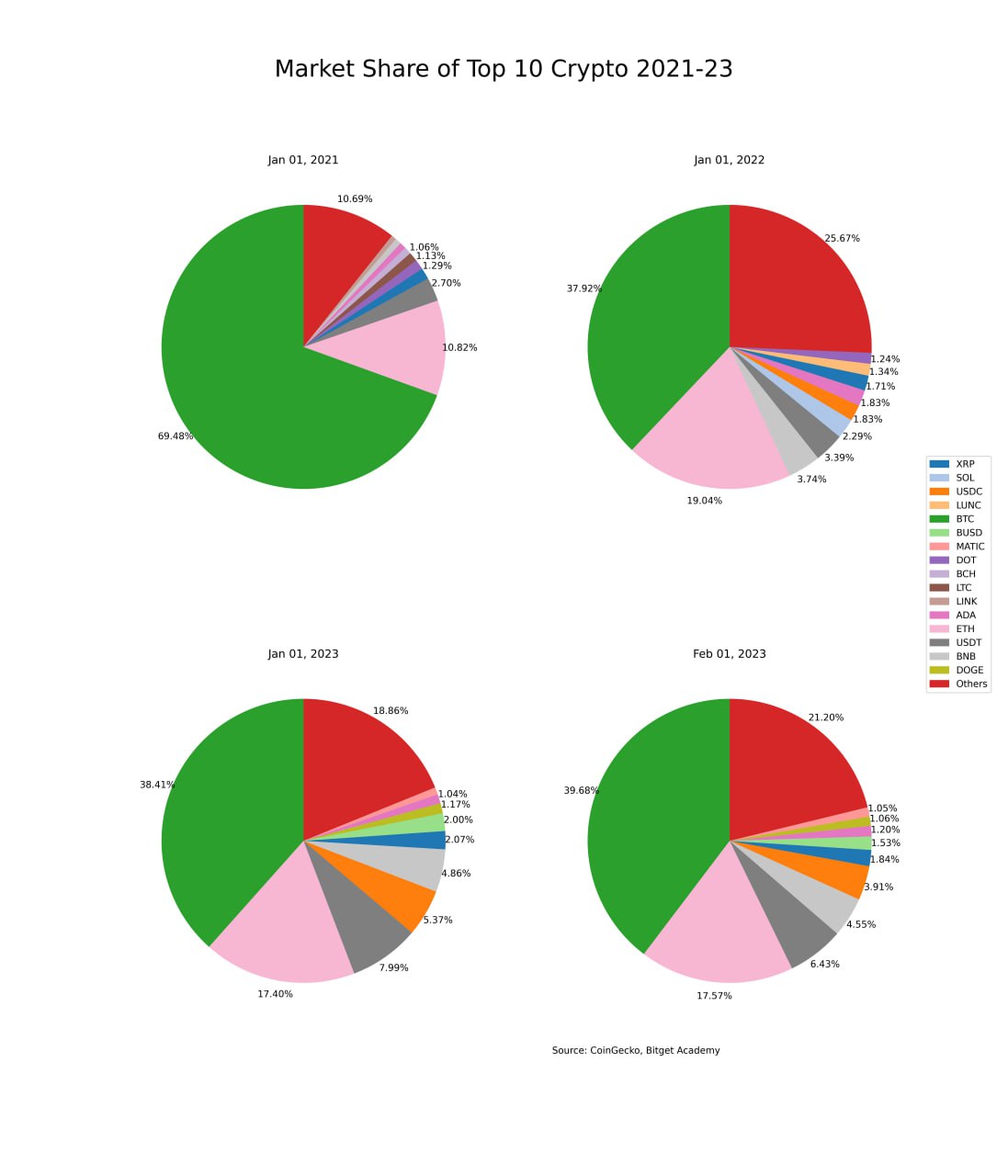

Over the course of three years from 2021 to 2023, there are six cryptocurrencies that successfully maintain their places in the top 10: Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Ripple (XRP), Binance Coin (BNB) and Cardano (ADA). Two-timers include Polkadot (DOT), which lost its glamour in 2022 and Circle (USDC).

A trend observed in the market share changes over the last three years suggests that investors are more likely to seek lucrative opportunities from small-cap coins in the expanding phase, for example after Bitcoin’s winning year in 2021, and find a shelter in the one that starts it all during difficult times. In contrast, Ethereum’s market share has hardly changed. So as its staple-ness.

Embracing Bitcoin’s Dominance

Regardless of the ebbs and flows, we can still see the green (BTC) taking the biggest part of the pie. The only difference is that Bitcoin dominance has decreased by half, ranging between 36% and 46%.

According to the Bitcoin dominance chart below, a clear-cut segregation between the demand for Bitcoin and market sentiment happened following the Moon’s demise back in May 2022 and its aftermath. Market was in extreme fear, but surprisingly not for too long. From the Ethereum Merge announcement emerged a spark of hope that even endured the blow-up of FTX in November last year. That means investors have been actively exploring other options than Bitcoin.

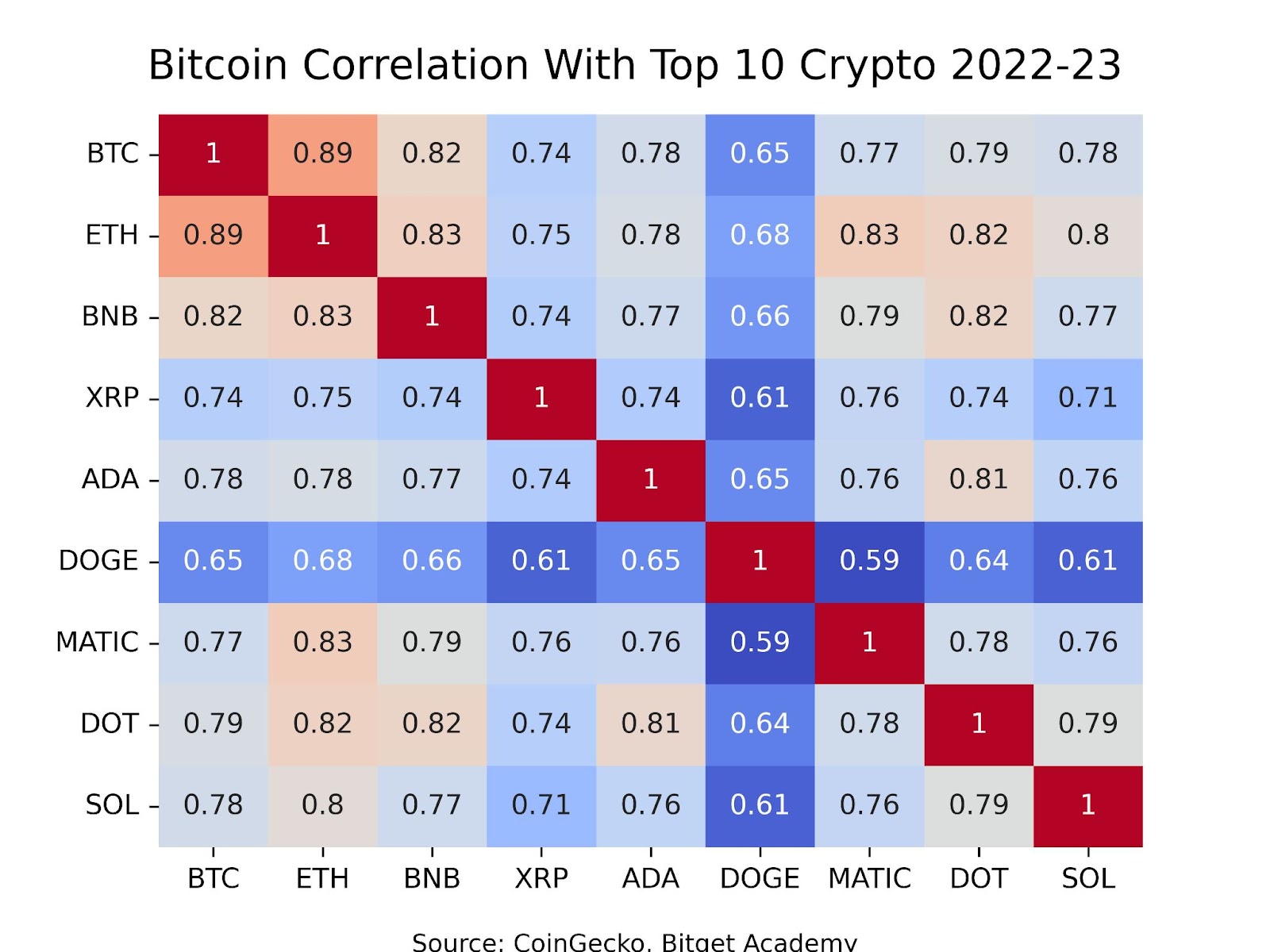

A lower dominance also means that other cryptocurrencies have room to shine and at the same time can benefit from Bitcoin’s any uptick. Except for Ethereum and Binance Coin, Bitcoin’s correlation with the rest of the top 10 stays below 80%, and in the extreme case of DogeCoin (DOGE), showing only 0.65.

So, basically, DogeCoin price should rise in line with Bitcoin whilst being able to have its own moment. Like this:

Source: Google Search

The premise above, together with the following statistics, can help reaffirm the faith in this emerging market. To truly become an integral part of the global financial system, Bitcoin and cryptocurrencies have first to get more people onboard, that is, more people to use Bitcoin as a means of exchange, to invest in Bitcoin or to hold them as a store of value. Data from CoinGecko shows that there are a total of 23 publicly traded companies holding 174374.47 Bitcoin (0.9% Bitcoin total supply) in their balance sheet; only two in the top 5 are mining firms and one is the mobile payment giant Square.

You can track the daily performance of crypto-related stocks via our daily report: Bitget Bites

The more institutions to have Bitcoin in their books, the more inspired towards the coin traditional finance and retail investors in general can become, thus an acceleration of adoption.

2022 was the year when PayPal enabled Bitcoin purchase, transfer, send and receive, Visa and MasterCard mapping out new development plans for Bitcoin services. Per Statista, the number of Bitcoin ATMs worldwide (latest stand on November 15, 2022) increased by 13% from January to November 2022. And feel free to check out businesses that accept Bitcoin payment here:

• spenabit (US businesses only)

• coinmap

As an investment, Bitcoin is often considered risky because of its high volatility. Does volatility always mean loss? Absolutely not.

Bitcoin has the highest volatility at 3.36, which is 1.5 times higher than the volatility of the NASDAQ Composite Index and 1.8 times gold. The NASDAQ Composite Index tracks over 2,500 companies in the technology sector, hence seen as a riskier investment than others such as the SP 500 Index or the Dow Jones Industrial Average, while gold is the traditional store of value.

Note that Bitcoin’s volatility is higher for a good reason: as an investment, its YTD returns (captured on February 10, 2023) is 28% compared to NASDAQ’s 12%, and as a store of value, it obviously outshined gold’s minus 4.82%. The corresponding Sharpe ratio, a useful tool to measure the risk-adjusted return, of Bitcoin is 6, surpassing all other assets but with much lower correlation to the indexes. It must be highlighted that these numbers represent only a short period of time, and as a result should be used for reference only.

Nevertheless, it proves that the risk-return trajectory for Bitcoin could be embraced for the short term as well as the long term, considering that Bitcoin has made a remarkable comeback to US$25,000 in the last days of February 2023. One attribute that Bitcoin shares with gold is its scarcity - Bitcoin total supply is 21 million with 1,457,070 probably lost forever (Source: Glassnode). In addition, Bitcoin’s inherent portability, divisibility and verifiability make it a better version of gold for anyone seeking haven in a digital asset.

Observations from a longer time frame (252 trading days of 2022) reveal that Bitcoin has the tendency to move in the same direction with gold (a commodity) and the three major U.S. indexes, which can serve as the justification for Bitcoin being the new asset class.

Simply create an account, and start exploring the incredible Bitget-Verse today!

Disclaimer

While we do our utmost best to make sure that the information contained herein is acquired from reliable sources, we provide information on an "as-is" basis with no representations as to the validity, accuracy, usefulness, timeliness, or completeness of any information. We are not responsible for any errors or omissions, losses, and/or damages arising from its display or use.

The information, views, and opinions expressed herein are those of Bitget at the time of publication and are subject to change anytime due to economic or financial circumstances and may not necessarily be updated or revised to reflect those changes that arise after the date of publication.

The views, information, or opinions expressed in the report are intended for informational and educational purposes only. It is not intended or offered to be used as legal, tax, investment, financial, or other advice. Under no circumstances are Bitget, our employees, agents, partners, and/or co-operations responsible for any decision made, action taken, or result obtained from or in reliance on the use of the information herein. Any investment or trading ideas, strategies, or actions should never be taken without first taking into consideration each individual's personal and financial situation, and/or without consulting financial professionals.

- Solana’s Two Worlds: Institutional Power Meets Memeconomy2024-11-19 | 20m

- 241119: Solana (SOL) Hits 3-Year High2024-11-19 | 5m