BGB Sail: June Edition

Our BGB Sail Series provides an in-depth analysis of BGB performance, together with a recap of the market situation at the end of each month.

BGB Sail: May Edition can be found here.

Market Summary

We definitely see some significant changes in the Top 10 list, with Litecoin (LTC) making its glorious comeback at the 10th place and Polygon (MATIC) falling 4 places to the 14th place. It seems that the upcoming Litecoin halving, estimated to take place on August 02, 2023, has been sending prices higher. Meanwhile, the price of MATIC, together with Cardano (ADA) and Solana (SOL), has been in free fall after the U.S. Securities and Exchange Commission (SEC) took legal actions against Binance and Coinbase, during the process of which they labelled several altcoins as ‘securities’. SOL’s losses must’ve been substantially offset by the liquid staking frenzy on this blockchain.

It’s also clear that the memecoin trend is cooling down, with the OG memecoin Dogecoin (DOGE) losing two places on the list as a result of the 29.9% drop in market cap. And the continued rise of Lido Staked ETH (STETH) represents the unwavering interest in this token as well as the liquid staking derivatives (LSDs) category in general. Most important is the market cap of Tether (USDT) only rose by 1.7% whereas that of Circle (USDC) went down by 5.5%, suggesting a new bullish sentiment as investors tend to swap their stables for other cryptocurrencies.

Now, let’s take a look at the performance of the Top 10 (excluding stablecoins and STETH). Bitcoin leads the pack as it has returned to the US$30,000 level towards the end of June - the highest since June 2022. In the case of Ethereum, the gap between Bitcoin and this ‘Mother of all Alts’ is wide enough; Ethereum failed to push through US$2,000 following Bitcoin’s recent spike even though it did break this mark briefly in April.

The two only cryptocurrencies to end H1 with a negative return include Binance Coin (BNB) and DOGE. Their year-to-date (YTD) returns are -5.4% and -9.8%, respectively. Binance has been facing mounting scrutiny in multiple jurisdictions, from the U.S., France, the U.K., the Netherlands, Austria to Brazil. Paxos ordered to stop issuing BinanceUSD (BUSD) in February this year has brought the exchange heavy losses, too.

Binance has been losing their market share accordingly. As demonstrated in the chart above, Binance’s spot volume began to contract approximately around late March, giving way for ByBit and Bitget. These two CEXs, who both started as derivatives exchanges only, rose to the occasion with the fall of FTX and are now sharing the 2nd and 3rd place in terms of spot market share. According to Nansen, Bitget is the only CEX to achieve an increase in its derivatives volume six months post-FTX.

We have mentioned the fading hype around memecoins, but it’s happening at a slackened speed. Other than DOGE and ShibaInu (SHIB), there are many new memecoins that have captured the market’s attention, and their combined number of searches far exceeds the searches for the mighty Bitcoin even. Less searched are NFT, LSD, DeFi, Staking and Buy Crypto in descending order, with Staking’s attractiveness kind of wearing off in Q2.

Here is the list of memecoins used for the chart, all available on Bitget:

• DOGE: Bitget Spot Trading, Bitget Spot Margin Trading (up to 5X), Bitget USDT-Ⓜ Futures

• SHIB: Bitget Spot Trading, Bitget Spot Margin Trading (up to 5X), Bitget USDT-Ⓜ Futures

• PEPE: Bitget Spot Trading, Bitget Spot Margin Trading (up to 3X), Bitget USDT-Ⓜ Futures

• FLOKI: Bitget Spot Trading, Bitget Spot Margin Trading (up to 3X), Bitget USDT-Ⓜ Futures

• BONE: Bitget Spot Trading, Bitget Spot Margin Trading (up to 3X)

• BABYDOGE: Bitget Spot Trading, Bitget Spot Margin Trading (up to 3X)

• AIDOGE: Bitget Spot Trading, Bitget Spot Margin Trading (up to 3X), Bitget USDT-Ⓜ Futures

• LADYS: Bitget Spot Trading, Bitget Spot Margin Trading (up to 3X), Bitget USDT-Ⓜ Futures

• VINU: Bitget Spot Trading

• TAMA: Bitget Spot Trading

The SEC’s hostile attitude towards and the banking crisis in the U.S. surely knocked stablecoin issuer Circle down. The ratio between USDC market cap and the aggregated market cap of USDT, USDC and DAI has declined from 38.4% on January 01 to 28.2% on March 30 and finally to 24.2% on June 30, 2023. With USDC being one key collateral for DAI, the YTD market cap of DAI (as of June 30) also decreased by 13.4% in the first six months, whilst USDT continues to dominate the stablecoin market with a market cap growth of 25.9% YTD.

The chart below shows how USDC’s depegging affects the stability of DAI: their deviation from peg usually moves in the same direction, to the same degree and oftentimes below peg (prices lower than US$1).

BGB Performance in June

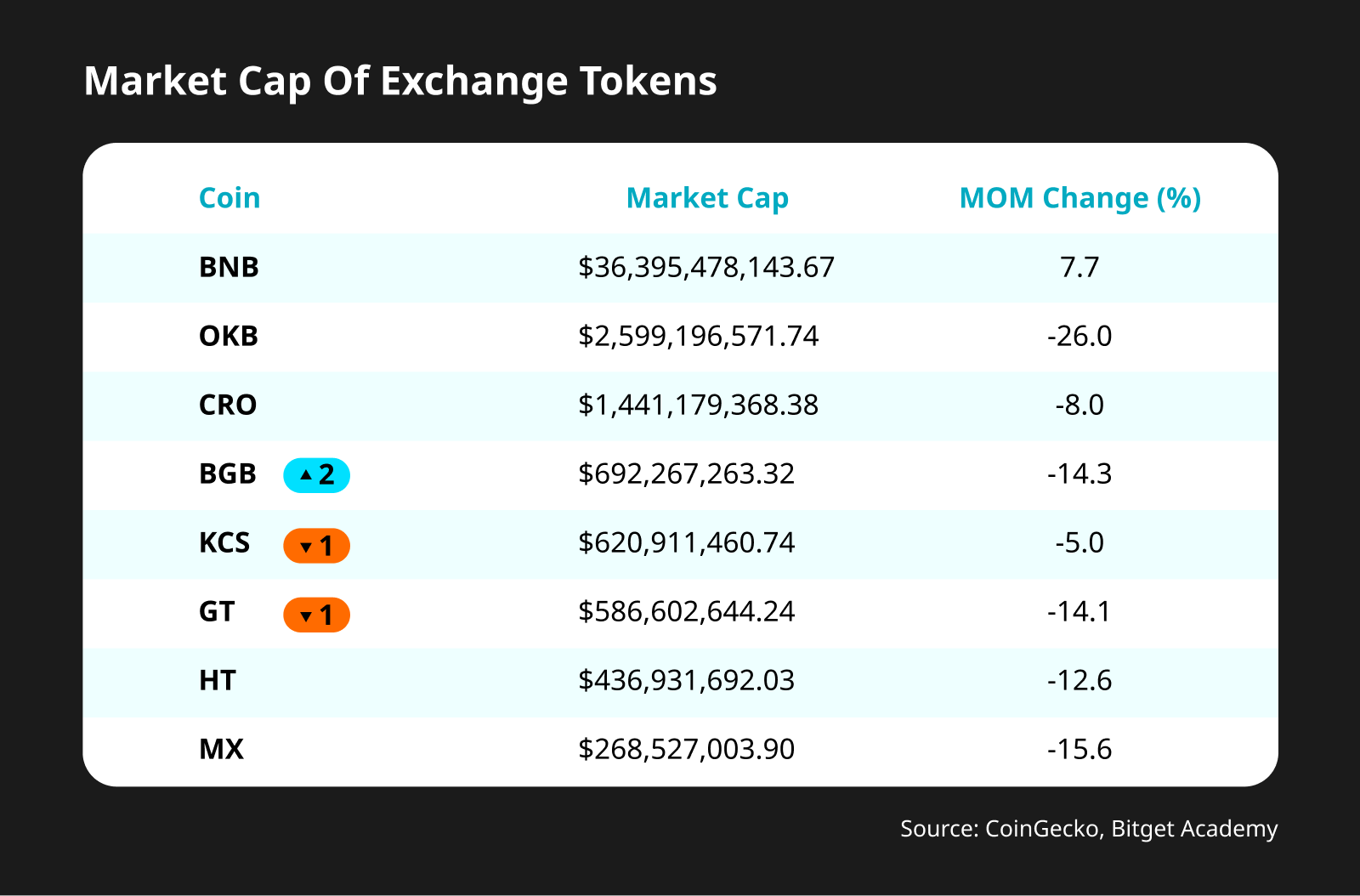

BGB continued its winning streak into June simply by scoring a near 10% MoM return. All other exchange tokens closed the month in red, with BNB being the biggest loser at 25.1%.

If you would kindly go back to the Top 10 performance chart, you’ll be seeing BGB outperform all Top 10 cryptocurrencies, locking in a YTD return of 171.9%. After hitting its new all-time high of US$0.515241 on February 16, 2023, BGB clearly became the new gem for crypto investors, which translates to a tremendous rise in demand and thus increasing volume. However, it wasn’t until May 11 when BGB price once again surpassed US$0.50 that volume levelled off at a higher position, meaning Q1 was more of a period of ‘testing the waters’ for BGB investors.

Although we all want positive returns, it's also important to examine if one asset is too unpredictable. The higher level of volatility, the harder it is to make sure that this asset will win. Yes, some breakouts may take place but it might not be a good long-term investment option. BGB is obviously the only exchange token to record a new all-time high this year. That results in higher volatility - periods of peak volatility match those times of new highs - but overall BGB prices didn’t seem to fluctuate as much as others in the same category.

The volume-to-market cap ratio is a simple measurement of liquidity that asks for a first-tier token’s standard requirement of 0.001. BGB maintained a real high yet stable liquidity from January to June, which is proved by a standard deviation of 0.0091. Simply speaking, the lower the standard deviation, the more ‘reliable’ the trend is because the values are much closer to the average. So BGB's near-best liquidity should be confirmed.

It’s been a wild ride for BGB, and we are glad to witness the growing appreciation for this wonderful token! By the end of June, BGB had made it to the Top 70 Cryptocurrencies by market cap and climbed two ranks to become the 4th biggest exchange tokens.

Recent data shows that BGB has become, once again, the exchange token with the highest potential. The disproportionate growth between BGB value and Bitget makes room for BGB to soar higher - we are indeed waiting for a new breakout.

To sum things up, BGB has never failed to impress. See yourself how:

Bitget-Verse

Holding BGB comes with an unending wave of perks as shown in the BGB White Paper. That, alongside our tireless efforts to bring new, outstanding products and services to the market, guarantees a magnificent flourish of the vibrant Bitget Ecosystem. A recent launch that aims to empower more crypto users is Bitget Crypto Loans, where anyone can deposit either BTC, ETH, USDT, XRP, LTC or BCH as collateral to borrow 15+ assets, and we will be adding new options soon.

Transparency Protection Earning Users’ Trust

Bitget has recently obtained operating licences from Lithuania and Poland, thus expanding our presence in the EU. Our compliance practices go hand in hand with our dedicated efforts in user protection, which originally began with the US$300 million Bitget Protection Fund. As of late June, the actual value of the Bitget Protection Fund stood at ca. US$395 million. Please note that the fund’s assets consist of both stablecoins (USDT, USDC) and Bitcoin, and we are committed to maintain the US$300 million value by depositing more assets when BTC prices fall.

Ever since the demise of FTX, it’s our priority to publish a snapshot of our reserves every month on Bitget Proof-Of-Reserves. Our total reserves ratio has never fallen below 200%, with the breakdowns for different assets on a monthly basis provided in the following charts:

It’s no surprise that there is a consistent upward trend for users’ funds. What the numbers are telling us is that more and more users have selected Bitget as their trusted CEX and/or engaged in more activities on the platform, especially ETH holders. The average amount of ETH deposited onto Bitget increased by 66% from Q1 to Q2, BTC by 32% and USDT by 22%. USDC deposits declined, understandably because of the concerns around Circle and this stable’s stability.

Spot Futures Activities

We are proud to celebrate the addition of new trading pairs on Bitget USDT-Ⓜ Futures and Bitget Coin-Ⓜ Futures:

• QNTUSDT

• MAVUSDT

• ANTUSDT

• ZZZUSDT

• RADUSDT

• MDTUSDT

• AMBUSDT

• DOGEUSD

• TRXUSD

• DOUSD

The average US$3,301,273,400 in aggregated open interest means that we were able to keep our traders engaged during the first six months of the year. Bitcoin was, without a doubt, the most popular asset with a dominance ranging between 0.65 and 0.71. The ray of hope sparked by BlackRock’s spot Bitcoin ETF application at the end of June drove up the speculation, stimulating the derivatives markets.

To contribute to LSDs’ sustainable growth, Bitget has added STETH as a margin option on Bitget Coin-Ⓜ Futures, and are in the process of exploring more options still. Either way, Bitget is the first to support LSDs collateral for futures trading, providing unparalleled flexibility for traders.

Further explanations for Bitget’s ascension in spot can be found here: we have been able to announce the initial listing of extraordinary deals and thus whetting the appetite of gem-seekers, arbitrageurs, and general investors alike.

The total volume of Bitget Spot Trading in June went up by 67.6% to US$9,001,820,134, mainly thanks to the initial listing of the most sought-after tokens:

• MAV/USDT

• MTC/USDT

• AWT/USDT

• SXS/USDT

On a quarterly basis, Bitget spot markets have expanded by 88.1% by the end of June. Oftentimes the new listings on Bitget Spot Trading are accompanied by profitable earning schemes, for example Bitget Launchpool. The estimated reward value for all five farming rounds of June comes in at over 141,000 USDT.

Furthermore, there are a great variety of savings opportunities to be updated on Bitget Savings regularly, with the latest fixed savings additions being SAND and DAI. GPTG, AWT, MTC were the initial listings that came with flexible savings slots of 200% APR and SXS 150%.

Earning With Bitget

We have been continuously expanding the variety of investment products on Bitget, with Bitget Range Sniper being the latest introduction. The lowest APR on Bitget Range Sniper up until now is guaranteed at 20% despite your speculation of market sentiment, the highest is up to 500%, and that's why Bitget Range Sniper has become the new obsession of many investors.

Source: Bitget Range Sniper

Bitget Range Sniper differentiates itself from other earning schemes on Bitget in that the asset to be paid out is flexible. In case the market moves in the opposite direction to your prediction, you'll get the payout in Bitcoin or Ethereum, which is perfect because you can hold them and lock in the profit once prices go up. If prices progress in line with your expectation, your profits will be realised immediately by the payout in USDT. You win, either way.

Also allowing investors and technical analysts to ride with the waves is Bitget Smart Trend. Bitget Smart Trend is principal-protected, which means investors have the opportunity to place a bet on BTC/ETH prices of the next seven days without worrying about losses at settlement. You can subscribe to Bitget Smart Trend with Bitcoin or Ethereum or USDT, but the gains are distributed in the form of the asset you use to subscribe. And guess what? BGB holders can now join the Bitget Smart Trend waves by subscribing with BGB! This option allows for both asset types (BTC/ETH) and both directions (bullish/bearish).

Source: Bitget Smart Trend

Bitget Dual Investment takes full advantage of the ‘buy low, sell high' strategy. It's designed to provide long-term investors with a 2-in-1 plan; that is, subscribers can buy a cryptocurrency (with stablecoin) and earn interest in that cryptocurrency if its price at the end of the subscription period is equal to lower than their expectations. If the price of that cryptocurrency is eventually higher than the expected price, purchase is not enabled and interests are calculated in stablecoins. That's the Buy Low scenario.

On the other hand, Sell High subscribers will sell their crypto holdings at a favourable price in the future and earn interests in stablecoins. Should markets move against them at the end of the subscription period, no selling is allowed and interests are calculated in the cryptocurrency to be subscribed. In short, users will receive their original holdings plus interests even in disadvantageous conditions.

Imagine planning your long-term crypto investments. You can either let your stables sit there until your limit order is filled or jump to Bitget Dual Investment to make some extra money on the idle funds.

Now back to Bitget SharkFin, the original capital-guaranteed structured investment product. There are 12 rounds of SharkFin in June with the options of earning BTC from BTC deposit, earning BTC from USDT deposit, earning ETH from ETH deposit and earning ETH from USDT deposit. 100% of the cases ended up in the Shark Scenario, which is the scenario with much higher APR, hence subscribers turned out to be winners all the time.

The charm of Bitget Earn is irresistible. In June only, the total fund subscribed to these four products amounted to US$32,194,514, which is equivalent to a 181% increase from last month. Bitget SharkFin is the most popular one not only in terms of the total amount subscribed but also pertaining to the number of subscribers. Bitget Smart Trend and Bitget Range Sniper were only introduced in March - April, but words spread like wildfire and Bitget Smart Trend thereby saw an incredible increase of 13,727% in the monthly subscription value and 598% in the number of monthly subscribers in just three months. The corresponding figures for Bitget Range Sniper are 6,017% and 571%.

For long-term investors, fasten your seatbelt ‘cause Bitget Dual Investment is undergoing a BIG upgrade! Expect 300% APY (conditions apply), daily subscriptions and VIP subscriptions and enjoy the versatility and flexibility of ‘buy low - sell high’!

Full guide to these products can be found here: Bitget Range Sniper | Bitget Shark Fin | Bitget Dual Investment | Bitget Smart Trend

Learn Earn With Bitget Academy

We believe in the power of crypto education. In 2023, so far we have released over 700 educational articles in 20 different languages on Bitget Academy, covering everything from in-depth guides and practical tips to market updates.

Looking for the best ones to read? Here are some suggestions:

The Tether Depeg in Summer 2023

Everything you need to know about Ethscriptions

How e-HKD Could Potentially Fuel the Rise of Tokenized Assets and Crypto Adoption?

What is a Crypto ETF? Your Comprehensive Guide to Crypto ETF

To help users better gain a deeper understanding of the concepts, we also regularly hold Learn Earn events on our social media channels. This is where you can test your knowledge and win amazing rewards!

In an attempt to empower younger generations as well as newbies with Web3 knowledge for an inevitable decentralised future, we have launched the Blockchain Fundamental Course with three modules and a certificate upon the completion of each!

Join us now on these bountiful events:

Copy trades of new pairs, unlock $21,000 in USDT! MDTUSDT is available on One-Click Copy Trade

Mid-Year Jamboree: Get 20 USDT More!

80,000 BGB Giveaway! Deposit EUR or GBP Now!

80,000 BGB Giveaway! Deposit BRL Now!

Bitget Builders Million Fans Program:Share the $5,000 Welcome Bonus Win the MacBook Air

Invite friends to Earn and get a 20% rebate!

[Initial Listing] Bitget Will List Hoppy (HOPPY) in the Innovation and Meme Zone!

[Initial Listing] Bitget Will List Arkham (ARKM) in the Innovation Zone and Web3 Zone

L (L) Savings is Live! Subscribe Earn up to 120% APR !

Simply create an account, and start exploring the incredible Bitget-Verse today!

- Solana’s Two Worlds: Institutional Power Meets Memeconomy2024-11-19 | 20m

- 241119: Solana (SOL) Hits 3-Year High2024-11-19 | 5m