Bitget Annual Briefing 2022-23: The Rational Path Ahead (Part 3)

A guide on how to embrace the year of 2023

Exchanges Are Finding New Ways To Cultivate Trust

The FTX blowup single-handedly seemed to have shaken up the entire centralised exchanges (CEXs) sector. But it is not really the truth.

Data shows that despite the fear, uncertainty, and doubt (FUD) surrounding CEXs and their transparency, trading volume on 13 major exchanges do not reflect a distinct deterioration of trust (see the columns for “Dec 22”, “Jan 23” and “Feb 23”). Please note that data for February 2023 (“Feb 23”) was recorded on February 10, 2023, hence the volume demonstrated does not represent the full month's data.

Given that there was no Black Swan event or any sudden shock to the market in February 2023, we can assume that the month's volume triples the figure calculated in the chart and equivalent to those observed in June, July and August 2022, which were after the Terra dismay and before the FTX collapse.

Futures volume equals a small proportion of spot volume, meaning that market speculation indeed intensified (via a surge in spot trading) after Terra failed, and only weakened in the month of the Christmas and holiday season.

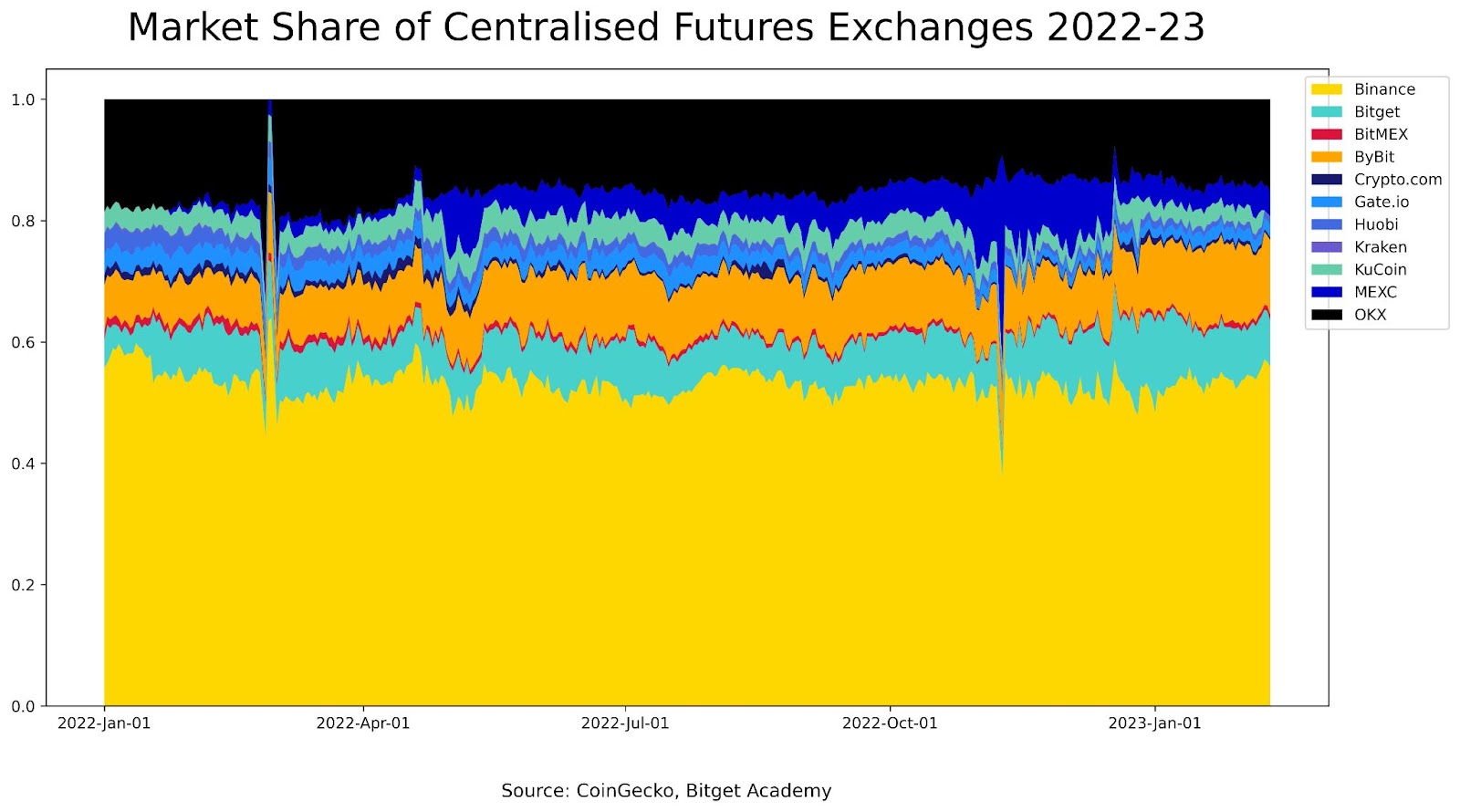

Binance has been dominating the CEXs sector in terms of both spot and futures markets. Over the same period, Binance spot volume witnessed a gradual growth while its futures market didn't expand at all. What is worth noting is the rise of some other exchanges post-FTX, including ByBit and Bitget for spot and Bitget and Kucoin for futures.

A breakdown of average daily volume shows that only Binance and Bitget were able to experience active spot trading activities in the first 40 days of 2023, while others had to deal with the shrinking of their spot markets - an indicator of lower revenues. For futures trading, the three standing men are ByBit, Bitget and Binance.

Below is a summary of exchanges and their tokens' performance. The exception is Coinbase as they went public on NASDAQ. Offshore exchanges launch their own tokens, naturally after they have established themselves successfully. In the beginning, holders of exchange tokens used them mostly for fee reduction and for Initial Exchange Offerings (IEOs), but the range of services involving exchange tokens has been extended, through which these tokens' value appreciates.

Since Coinbase stock (NASDAQ: COIN) hit its all-time high in November 2021, COIN price has plummeted, resulting in an 85.90% value loss at the end of 2022. The performance of Crypto.com exchange token (CRO), which is the native token of Crypto.com's own blockchain, was the worst out of nine exchange tokens. Except for Bitget Token (BGB), which rose proportionately to the exchange's flourishing, it's understandable that these tokens' prices fell - FTX and its token FTT surely made people shy away from holding exchange tokens.

As of February 10, 2023, the market recovery appeared to have resurrected most exchange tokens excluding Huobi Token (HT). Huobi was reported to have laid off a big portion of their payrolls as well as cutting back on employees' incentives, thus the price dropping. The top three exchange tokens/exchange share by performance so far include Coinbase's COIN, Bitget's BGB and OKX's OKB.

The rolling 7-day average daily return of exchange tokens can help identify the main price trend for these tokens by smoothing out daily fluctuations that come from the inherent volatility of crypto markets. Higher highs and lower lows can be seen with COIN of Coinbase, HT of Huobi and BMEX of Bitmex. A less volatile token with a tendency to follow upward trends is Bitget's BGB, which is also the single token ended February 10, 2023 on a positive note.

FTX, the troubled exchange that saw liquidity crunch after Binance unloaded their token (FTT) holdings, caused investors' trust issues regarding the reserve of centralised exchanges. Exchanges have quickly produced their proof-of-reserve (PoR) to become more transparent and restore users' trust. The latest data from Nansen shows that exchanges host a big percentage of their reserves in stablecoin (Tether is more favoured than USD Coin), Bitcoin, Ethereum. Bitget keeps one-third of their reserves in Bitget Token, whereas ca. 30% of Binance, Crypto.com, Gate.io, Huobi and KuCoin’s reserves are held in small caps or more vulnerable assets, for example, Shiba Inu (SHIB).

Institutions Are Staying Put

Crypto funding has faced some setbacks since May 2022 because the Terra case triggered the bankruptcy of Three Arrows Capital (3AC), one of the major crypto funds. However, institutions persisted in looking forward, especially when the Ethereum Merge was completed without any trouble. The number of deals began to pick up pace around the end of 2022. Again, the data was recorded on February 10, 2023, therefore February figures may not reflect the right institutional sentiment. Big players are most likely to participate in Seed and Pre-Series A rounds.

The most popular category of funding deals is blockchain services at 35.6%, higher than DeFi and GameFi combined. The $650 million Ronin bridge hack of Axie Infinity resulted in a declining interest in GameFi projects in the second half of 2022. Surprisingly, CeFi companies on average received more capital than NFT Metaverse projects, although the gap is not too wide.

Another way for traditional finance (TradFi) to merge with crypto is through trading crypto ETFs. As Bloomberg pointed out, crypto ETFs performed really well in the first days of 2023, securing the first 14 spots by year-to-date return on January 13, 2023.

Take the NASDAQ Composite Index (the bold pink line) as the benchmark and we can see that the new year sent crypto ETFs soaring. The one ETF seeing losses is ProShares Short Bitcoin Strategy ETF for justifiable reasons: Bitcoin prices went up. Considering the fact that the NASDAQ index often outperformed other indexes such as the SP 500 or the Dow, crypto ETFs should convince more risk-takers in TradFi to explore this emerging industry.

Simply create an account, and start exploring the incredible Bitget-Verse today!

Disclaimer

While we do our utmost best to make sure that the information contained herein is acquired from reliable sources, we provide information on an "as-is" basis with no representations as to the validity, accuracy, usefulness, timeliness, or completeness of any information. We are not responsible for any errors or omissions, losses, and/or damages arising from its display or use.

The information, views, and opinions expressed herein are those of Bitget at the time of publication and are subject to change anytime due to economic or financial circumstances and may not necessarily be updated or revised to reflect those changes that arise after the date of publication.

The views, information, or opinions expressed in the report are intended for informational and educational purposes only. It is not intended or offered to be used as legal, tax, investment, financial, or other advice. Under no circumstances are Bitget, our employees, agents, partners, and/or co-operations responsible for any decision made,bitget-annual-briefing-part-three action taken, or result obtained from or in reliance on the use of the information herein. Any investment or trading ideas, strategies, or actions should never be taken without first taking into consideration each individual's personal and financial situation, and/or without consulting financial professionals.

- Solana’s Two Worlds: Institutional Power Meets Memeconomy2024-11-19 | 20m

- 241119: Solana (SOL) Hits 3-Year High2024-11-19 | 5m