Uncertainty looms for crypto industry and stablecoins ahead of key EU MiCA deadline

Quick Take A key MiCA deadline in the European Union is approaching on June 30, impacting the regulation of the cryptocurrency and digital asset market across member states. MiCA also impacts stablecoins, affecting their issuance, operation and oversight within the EU — though uncertainty remains on what this means for the industry.

The Markets in Crypto-Assets regulation — a comprehensive regulatory framework established by the European Union to regulate the cryptocurrency and digital asset market across member states — is approaching a key deadline on June 30.

MiCA, overseen by the European Securities and Markets Authority, was approved by the European Parliament in April 2023 — mandating that stablecoins issued in the region must pass increased regulatory requirements.

MiCA’s implementation rolls out in different phases , with the upcoming deadline primarily for crypto asset service providers and other entities operating in the crypto space to comply with certain stipulations set out in the regulation, including registration and KYC/AML requirements, bringing a transitional period for businesses that were already in operation before MiCA's adoption to an end. Entities that do not comply may be fined and barred from operating within the European Union until they meet the regulatory requirements.

Other provisions, including some that apply to stablecoins, are being phased in over time, with full compliance for all aspects required by December 2024. Requirements on stablecoin issuers also include mandatory registration and affect their issuance, operation and oversight within the European Union.

While existing stablecoin issuers must begin aligning their operations with certain MiCA requirements from the June 30 deadline, the most stringent requirements, such as capital and reserve obligations, come into full effect later, ensuring a transitional period for existing businesses to adapt. Stablecoin issuers operating outside the EU but providing services to EU residents will also need to comply with MiCA regulations, potentially leading to significant changes in their operational and compliance strategies globally.

Uncertainties persist for the crypto industry

Despite the limited timeframe, questions still remain regarding MiCA’s implementation requirements and how users, issuers and crypto exchanges may be impacted across the region.

“As the critical 30 June deadline for the Markets in Crypto-Assets (MiCA) regulation approaches, companies are struggling to navigate the ambiguities embedded in these new rules. MiCA was intended to provide clarity and certainty in the European crypto market. Yet, as the date nears, significant uncertainties persist, raising concerns across the industry,” Oliver Linch, CEO of Bittrex Global and former Shearman & Sterling solicitor told The Block.

“The adoption of MiCA was hailed as a great landmark, but as I said at the time, it was just the start of a wider process of implementing technical standards. A year after MiCA was adopted, and mere weeks from the implementation date, there is still a real lack of clarity on several important issues,” Linch added.

The Bittrex CEO said the uncertainty was a significant problem for the EU, with legal experts across the region struggling to provide consistent advice on the core requirements and national regulators facing challenges in its enforcement. “The lack of decisive and coordinated action, which was the core promise of MiCA, is now evident,” Linch said, criticizing the decision-making process and leadership at the EU level for not taking problems that were highlighted months ago more seriously.

“Stablecoins are the first component of the digital assets sector to come under MiCA’s regulatory umbrella, due to their systemic importance and potential risk. As the world watches this crucial test of MiCA’s efficacy, the stakes are certainly high. But instead of the anticipated regulatory clarity, confusion and chaos seem to dominate the landscape,” he added.

In a January paper , Patrick Hansen, Director of EU Strategy and Policy at Circle and Helmut Bauer, Senior Advisor at the E-Money Association, also highlighted some concerns for the industry.

“If the status quo is maintained, stablecoin providers will face the cliff-edge effect of being considered significant in the EU, which in turn could significantly impact their business model. For issuers of global stablecoins, non-EU jurisdictions lacking a similar framework, or jurisdictions with a more flexible, discretionary and conservative set of indicators and thresholds, could look much more attractive from a supervisory perspective,” they wrote.

What crypto exchanges and stablecoin issuers say

On June 3, Binance, the world's largest cryptocurrency exchange by trading volume, said that from June 30, it would restrict access to "unauthorized" stablecoins without mentioning any specific assets.

Binance CEO Richard Teng later clarified that "Binance won't delist any unauthorized stablecoins on spot but will limit their availability for [European] users only on certain products," adding "updates on regulated stablecoins will be shared soon."

However, Binance appeared to concede the looming regulation could present challenges. "Currently there are few regulated stablecoins with limited liquidity that may not be sufficient to support sudden demand across the industry," the exchange said in a blog post at the time.

Meanwhile, rival exchanges Kraken and OKX have also recently been forced to consider MiCA's potential impacts. As of last month, Kraken was "actively reviewing" whether to delist USDT, according to a Bloomberg report .

However, Kraken later clarified that it had no current plans to delist Tether or alter its USDT trading pairs. “Kraken has no plans to alter offerings for clients in the EU at this time. Our European clients value the breadth and depth of Kraken’s services, and we continue to look at all options to continue to offer all these services under the upcoming regime. We will of course follow all legal requirements and continue to work with regulators on how best to interpret upcoming rules and advocate on behalf of our clients," a Kraken spokesperson recently told The Block.

In March, OKX, the world's fourth-largest cryptocurrency exchange by trading volume, said it was ceasing support for USDT trading pairs in the European Economic Area. The delisting "supports the launch of [euro] on-ramps for EEA-based customers," a spokesperson told The Block, adding that the change affects only a "small subset" of its user base.

Last week, Tether CEO Paolo Ardoino told The Block that the EU’s MiCA regulation “contains several problematic requirements” that “could not only render the job of a stablecoin issuer extremely complex but also make EU-licensed stablecoins extremely vulnerable and riskier to operate.”

In April, Ardoino said that Tether was "still discussing with the regulator about our concerns" regarding the EU’s possible requirements for capital reserves.

“Uninsured cash deposits are not a good idea,” he added. “We should learn from what happened with Silicon Valley Bank and another major stablecoin in the U.S. If a bank goes bankrupt, uninsured cash goes into bankruptcy. Stablecoins should be able to keep 100% of reserves in treasury bills, rather than exposing themselves to bank failures keeping big chunk of reserves in uninsured cash deposits. In case of bank failure, securities return back to the legitimate owner.”

The vast majority of the roughly $110 billion of USDT in circulation at the end of the first quarter were backed by U.S. Treasurys, according to an attestation published last month .

Ardoino said in the lead-up to the impending effective dates for stablecoin issuers and crypto asset service providers in the EU that "Tether has engaged extensively with its exchange counterparties in Europe regarding the requirements, including those pertaining to the ongoing listing of USDT and other Tether tokens, and the interpretation of key regulatory provisions."

While Tether is "optimistic about MiCA's implementation," it remains "crucial that stablecoin regulatory policies enacted are balanced, protect consumers, and nurture growth in our emerging industry," Ardoino said.

“One year after MiCA's adoption, the lack of clarity on key issues remains a pressing concern. The regulation, heralded at the time of its adoption in June 2023 for offering the certainty missing in other jurisdictions (notably the U.S.) now appears to be buckling under the weight of scrutiny,” Linch added. “Exchanges in particular are left in a precarious position, needing to make critical decisions about whether and under what conditions to continue listing stablecoins, without the promised regulatory clarity.”

The Block reached out to numerous other crypto exchanges on the impact of MiCA regulations in the EU on stablecoins from June 30, though their plans were still seemingly being hashed out.

“HTX has no further comment on MiCA regulations,” a spokesperson for the crypto exchange formerly known as Huobi told The Block.

Bitpanda, a European-focused crypto exchange and multi-asset broker platform based in Vienna, Austria, said it wasn’t commenting on the topic currently as it was still working closely with the regulator to determine exactly how the changes will affect it.

“We are following developments as MiCA comes into effect, we support the development of clear regulatory frameworks such as MiCA, and such changes are considered under our existing standard practices,” a spokesperson for BitMEX added.

Meanwhile, Coinbase said it is committed to maximizing consumer choice and ensuring market stability. “We will continue to monitor the situation to assess which tokens meet the new MiCA compliance standards when the new rules come in,” a spokesperson told The Block.

“As 30 June approaches, the industry is left questioning whether MiCA will deliver the stability and certainty it promised, or if the EU will be plunged into further regulatory uncertainty; several even more thorny issues must be resolved before full implementation of MiCA at the end of the year. The eyes of the world are on the EU, and the outcome will undoubtedly shape the future of digital asset regulation globally,” Linch concluded.

Could MiCA boost Euro stablecoins?

While Europe has traditionally lagged the U.S. and Asia Pacific regions in terms of crypto trading, euro-backed stablecoins have consistently grown in volume since the beginning of the year, according to a Monday report by analysts at Kaiko — suggesting that demand is finally picking up in European markets.

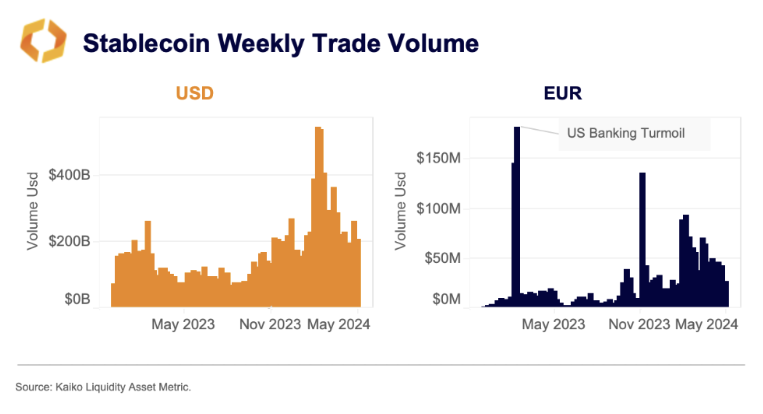

Stablecoin weekly trade volume. Image: Kaiko .

The total weekly trading volume of Tether’s EURT, Stasis EURS, Société Générale’s EURCV, Anchored’s AEUR and Circle’s EURCV has consistently exceeded $40 million since March, the analysts said — the longest period on record, with AEUR accounting for more than 50% of the total volume.

USD-backed stablecoins continue to dominate the stablecoin market, however, with average weekly trading volumes of $270 billion around 70 times higher than their European counterparts, according to the Kaiko analysts.

“USDT against EUR trading pairs are currently among the highest volume instruments exceeding EUR-denominated Bitcoin volume by a large margin on both Binance and Kraken. This suggests these exchanges are an important fiat off-ramp for EU traders,” they said.

While Tether’s trading volume is centered around U.S. hours, “it’s clearly still a crucial trading asset for European users,” the analysts added. However, the impact of MiCA could see users shift to other stable assets in the region.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Over 68% in US choose Bitcoin after tariffs

Michael Saylor’s $21 Billion Bitcoin Acquisition Plan

Two Prime Drops Ethereum, Focuses on Bitcoin

Two Prime Shifts Focus from Ethereum to Bitcoin