Nexa (NEXA): Scalable Layer1 blockchain under fair startup principles

远山洞见2024/07/17 06:03

By:远山洞见

I. Project introduction

Nexa (NEXA) is a decentralized blockchain project built on UTXO Layer-1, hailed as one of the most scalable blockchains ever. Its design goal is to provide efficient and low-cost payment and transaction solutions that support a wide range of application scenarios. Nexa aims to provide users with an excellent user experience through its innovative Technology Implementation with high throughput and fast transaction confirmation. Currently, according to official data, its scalability can handle over 10 billion transactions per day.

II. Project highlights

Nexa (NEXA), as a scalable Layer1 blockchain, has the following highlights:

Scalability: Nexa's scalability is unparalleled, capable of processing over 10 billion transactions per day. This extremely high scalability ensures that the network can still maintain efficient and stable performance when processing large-scale transactions, breaking the traditional limitations of blockchain technology.

Proof of Work: Nexa's PoW (Proof of Work) algorithm is currently designed with a block generation time of 2 minutes, utilizing the huge scalability of mining incentives. This makes it possible for nodes to develop new hardware that can be used to accelerate transaction verification, achieving speeds unmatched by any other UTXO-based blockchain.

Global Capacity: Thanks to Nexa's unique PoW algorithm, Nexa will scale to more than 10 billion transactions per day without high fees or waiting. The new technology eliminates bottlenecks in bandwidth, storage, and computing speed for nodes.

Instant Transactions: Nexa uses advanced consensus mechanisms to ensure transactions can be confirmed instantly, improving User Experience and transaction efficiency.

Smart contracts: Nexa uses a scalable smart contract system that can achieve almost everything possible without encountering the major scaling bottlenecks suffered by Turing-complete networks.

III. Market value expectations

Nexa's market value is expected to be optimistic, based on its robust economic model and fair start principle that imitates Bitcoin. The slow release strategy of tokens, the halving event every four years, and the PoW algorithm strengthen its cyber security and decentralization, which can promote gradual market adoption and demand growth. Coupled with its ability to handle more than 10 billion transactions per day, Nexa sets a strong foundation to support future expansion and technological innovation, which may witness significant market value growth as the technology matures and market recognition increases.

IV. Economic model

Nexa's current circulating market capitalization is $20,405,744.569, ranking 703rd in the world. The fully diluted market capitalization is $17,989,888. The current circulating volume is about 5.80 trillion NEXA, the total supply is almost the same, and the maximum supply is set at 21 trillion NEXA.

The economic model of the project follows the principle of fair start-up, with token distribution and mining reward mechanisms similar to Bitcoin, halving every 1,050,000 blocks, and an initial block reward of 50 Nexa. Its PoW algorithm does not have pre-mining or early allocation, strengthening the decentralization and security of the network.

Nexa's supply plan is expected to be completed within 140 years, with an initial block reward of 10 million NEX every 2 minutes and halving every approximately 4 years. This strategy aims to slowly and steadily release tokens to balance market supply and demand, gradually increase their value, and drive long-term growth and adoption.

V. Team and financing

The Nexa team has senior industry experience, including chief developer Andrew Stone and Bitcoin Unlimited (B. U) president Andrew Clifford. Core team members have participated in multiple multi-billion dollar cryptocurrency projects, covering development, infrastructure, and marketing, and have played a key role in the development of Bitcoin and Bitcoin Cash software and solutions.

The financing information has not been disclosed yet. The project party claims that the development funds come from Bitcoin Unlimited.

VI. Risk Warning

1. The cryptocurrency market is volatile, and large price fluctuations may lead to investment losses. Therefore, cautious decisions should be made and market risks should be fully understood.

2. Nexa has many advantages in technology and application scenarios, but as an emerging project, it still faces risks in market competition, Technology Implementation, and regulatory environments.

VII. Official link

Website:

https://nexa.org/

Twitter:

https://x.com/nexamoney

Telegram:

https://t.me/nexacoin

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Solana Rivals Poised for Massive Gains—Turn $100 Into $10K Before Q2 Ends

Cryptonewsland•2025/03/29 01:55

Movement (MOVE) Price Gains 27% as Accumulation Builds and Bullish Momentum Takes Over

Cryptonewsland•2025/03/29 01:55

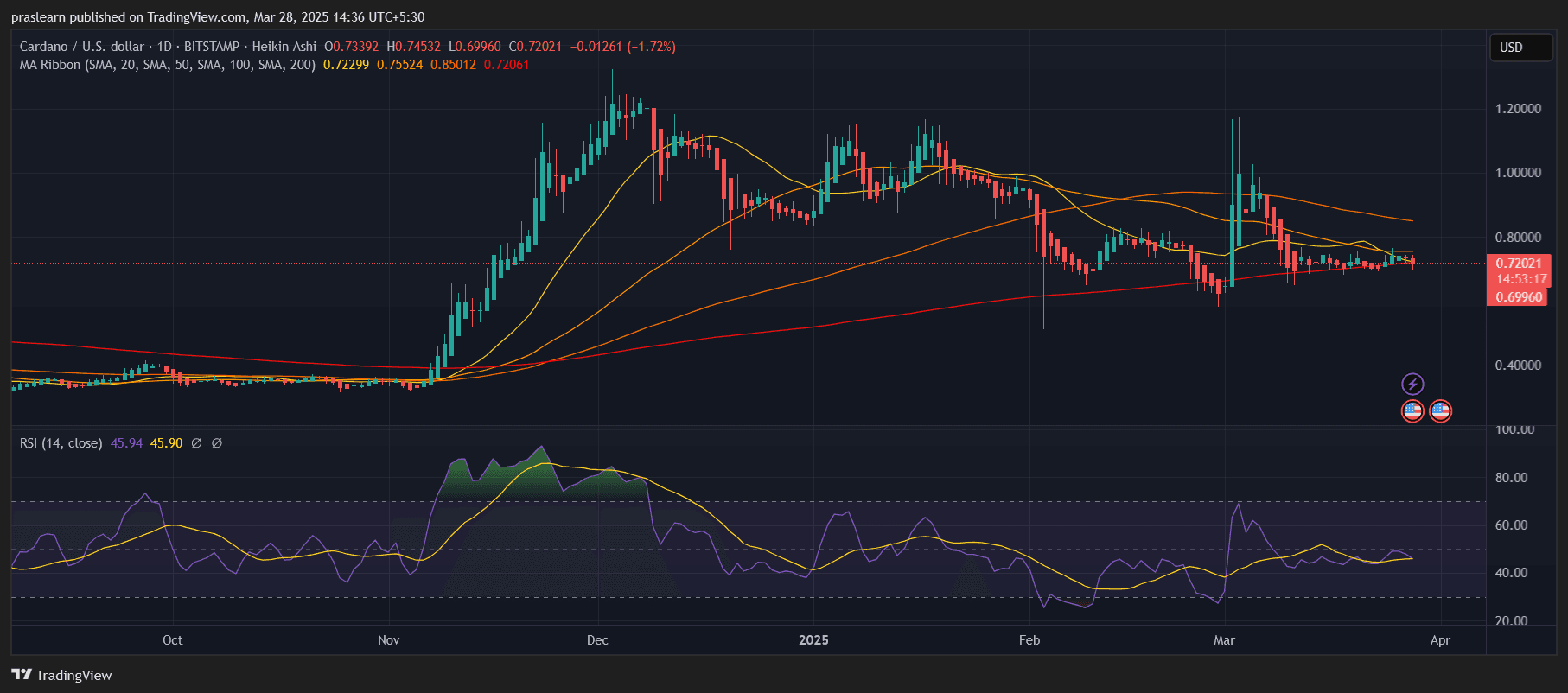

Cardano Aiming for $10? Big Move Coming?

Cryptoticker•2025/03/29 00:00

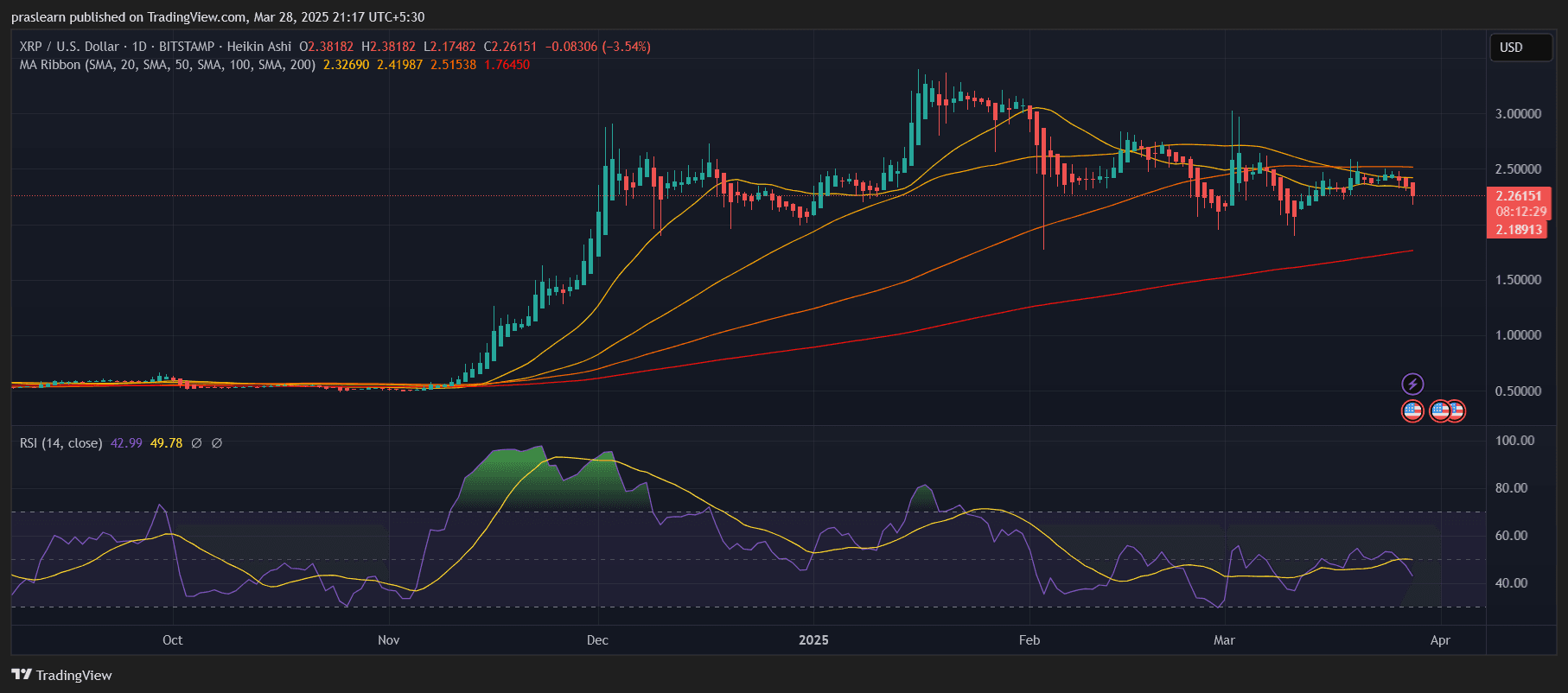

Will XRP Crash? Here’s What the Chart Is Warning Us About

Cryptoticker•2025/03/29 00:00

Trending news

MoreCrypto prices

MoreBitcoin

BTC

¥597,589.86

-3.37%

Ethereum

ETH

¥13,433

-2.13%

Tether USDt

USDT

¥7.26

-0.03%

XRP

XRP

¥15.25

-5.68%

BNB

BNB

¥4,381.61

-4.35%

Solana

SOL

¥910.95

-4.63%

USDC

USDC

¥7.26

-0.03%

Dogecoin

DOGE

¥1.24

-5.80%

Cardano

ADA

¥4.86

-4.70%

TRON

TRX

¥1.7

+1.77%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now