CoinShares says 'post-US election honeymoon is over' as macro and monetary policy weigh heavy on crypto fund flows

Global crypto investment products attracted modest net inflows of $48 million last week, masking large outflows later in the week due to stronger-than-expected macro data, according to CoinShares.Although adding nearly $1 billion during the first half of the week, outflows of $940 million followed in the second half, Head of Research James Butterfill noted.

Global crypto funds run by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares registered modest net inflows of $48 million last week as macro and monetary policy reasserted themselves, according to CoinShares.

While the week got off to a good start, with global crypto investment products attracting nearly $1 billion, the release of new macroeconomic data and the Federal Open Market Committee’s latest meeting minutes suggested a stronger U.S. economy and a more hawkish Fed, leading to outflows of $940 million in the latter half, CoinShares Head of Research James Butterfill noted in a Monday report.

“This suggests that the post-US election honeymoon is over, and macroeconomic data is once again a key driver of asset prices,” Butterfill said.

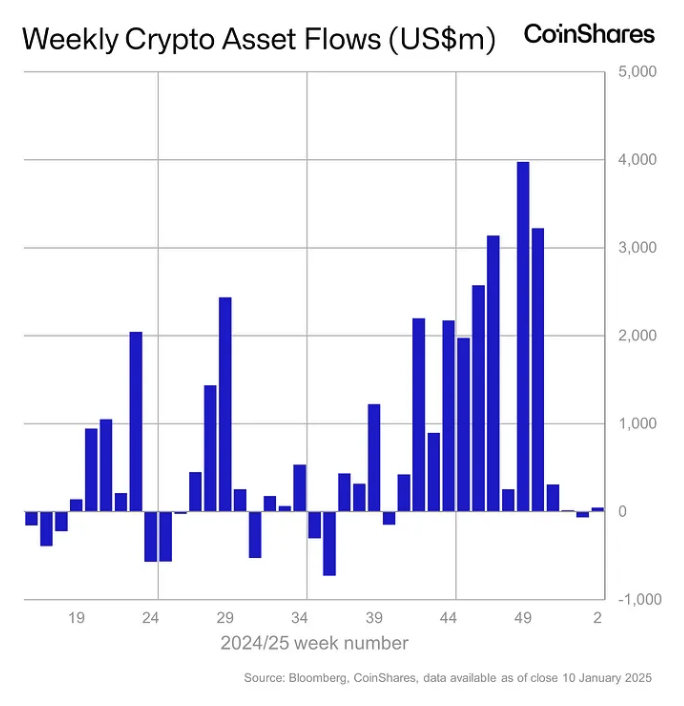

Weekly crypto asset flows. Images: CoinShares .

Bitcoin and ether’s mixed fortunes

Bitcoin-based investment products led last week’s net inflows globally, adding $214 million despite witnessing the largest net outflows later in the week. They remain the best-performing crypto funds this year so far, clocking $799 million worth of net inflows.

The U.S. spot Bitcoin exchange-traded funds represented $312.8 of the overall net inflows, according to data compiled by The Block, though U.S. markets were also closed on Thursday in observance of a national day of mourning for former President Jimmy Carter.

Ethereum-based funds suffered the most, experiencing net outflows of $256 million for the week. “We believe [this] is attributed to the broader tech sell-off rather than any specific issue with the asset,” Butterfill said, reflecting on the Nasdaq 100’s 3.5% decline over the period.

U.S. spot Ethereum ETFs accounted for $186 million of those net outflows last week, according to The Block's data dashboard.

However, XRP-based products managed to generate $41 million in net inflows last week amid heightened optimism ahead of the Jan. 15 Securities and Exchange Commission appeal deadline in the Ripple case, Butterfill said. Solana-based funds also saw net inflows of $15 million.

Despite poor price performance during the week, other altcoin-based products, including Aave, Stellar and Polkadot, also witnessed net inflows, Butterfill noted.

Bitcoin fell 7.8% over the past week and is currently trading for $90,897, according to The Block’s Bitcoin Price Page . Ether has dropped 14.8% and is now changing hands for $3,063.

Meanwhile, the GMCI 30 index, which represents a selection of the top 30 cryptocurrencies, is down 12.5% over the past week to 176.64.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How Elon Musk’s Starlink is cashing in on Trump’s tariff talks

Share link:In this post: Trump’s steep tariffs have prompted countries such as Lesotho to fast-track Starlink licenses as a gesture of goodwill toward the U.S. U.S. diplomats have quietly urged regulators worldwide to speed Starlink approvals during trade talks. By leveraging tariff threats, Washington is steering markets to American satellite services before Chinese competitors can move in.

UK becomes the first country to make a trade deal with Trump

Share link:In this post: Trump will announce a trade deal with the UK on Thursday from the Oval Office. The deal is the first since Trump imposed global tariffs earlier this year. Details are unclear, but it likely covers cars, tech taxes, and farm goods.

Governor Hobbs greenlights Arizona’s Bitcoin reserve fund after signing HB-2749 into law

Share link:In this post: Arizona Governor Katie Hobbs signed a bill into law allowing the U.S. state to keep unclaimed crypto and establish a ‘Bitcoin Reserve Fund’ not using taxpayers’ funds. House Bill 2749 will not allow investment but will transfer unclaimed assets, airdrops, and staking rewards into a reserve, creating AZ’s first crypto reserve. Earlier, Hobbs vetoed Senate Bill 1025, which would have allowed the state to invest up to 10% of treasury and pension assets in digital assets.

If You’ve Held XRP from $0.006 to $3, Expect Prices Beyond Expectations: Expert Says