Cboe BZX takes a crack at 'in-kind' redemptions for spot Bitcoin and Ethereum ETFs

The equities exchange posted an amended rule filing on Monday that would allow for in-kind redemptions and creations for the ARK 21Shares Bitcoin ETF and the 21Shares Core Ethereum ETF. Ahead of the U.S. Securities and Exchange Commission’s approvals for spot bitcoin ETFs over a year ago, firms were hashing out technical details over how the redemption process would work for those products.

Cboe BZX Exchange Inc. filed changes to allow for spot Bitcoin and Ethereum exchange-traded funds to allow for in-kind redemptions, instead of cash.

The equities exchange posted an amended rule filing on Monday that would allow for in-kind redemptions and creations for the ARK 21Shares Bitcoin ETF and the 21Shares Core Ethereum ETF. This comes just days after Nasdaq made a similar filing on behalf of BlackRock for its iShares Bitcoin Trust.

"The Exchange proposes to amend the ARK 21Shares Bitcoin ETF (the 'Bitcoin Trust') and the 21Shares Core Ethereum ETF (the 'ETH Trust' and, collectively with the Bitcoin Trust, the 'Trusts'), shares of which have been approved by the Commission to list and trade on the Exchange pursuant to BZX Rule 14.11(e)(4), to permit in-kind creations and redemptions," according to the filing.

Ahead of the U.S. Securities and Exchange Commission's approvals for spot bitcoin ETFs over a year ago, firms were hashing out technical details over how the redemption process would work for those products. The SEC favored a cash model that required issuers to move bitcoin out of storage, sell it right away, and then give the cash back to the investor.

Later, the SEC approved spot bitcoin ETFs in January 2024 with in-kind redemptions and later greenlit spot Ethereum ETFs in May. A potential change in process won’t mean that individual investors will be able to do “in-kind’ redemptions and creations, just the authorized participants involved, said James Seyffart, Bloomberg Intelligence ETF analyst, on Friday in a post on X.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

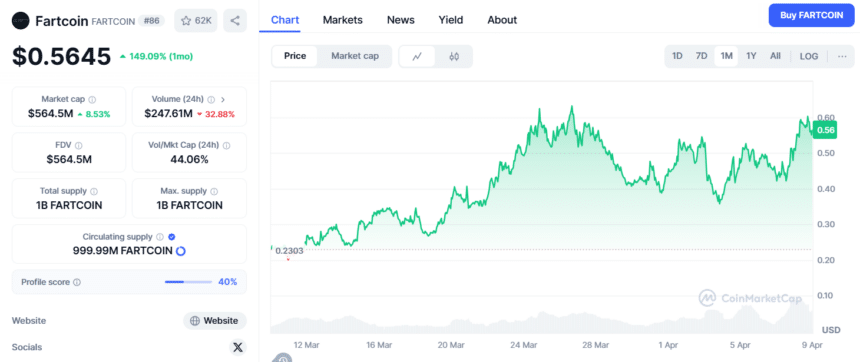

Fartcoin Surges in Value While Market Faces Setbacks

In Brief Fartcoin has increased by nearly 30% in the last 24 hours. Growing confidence among users as exchange reserves decline. Technical indicators predict a potential price target of $0.75.

Ethereum’s Price Drop Signals Potential Buying Opportunities for Long-Term Investors

In Brief The recent price drop of Ethereum may offer strategic buying opportunities. Historical data supports potential recovery after dips below realized price. Investor psychology plays a crucial role during uncertain market conditions.

Whale Makes Bold $1.89M Bet on Fartcoin, Would it play out?

FIL Price Over $150 Emerges as Filecoin Shows Highly Bullish Signals Amid Bitcoin Mirroring 2024 Correction