Altcoins and Meme Coins Drop Despite Trump’s Bitcoin Reserve Announcement

- XRP, Solana, and Cardano dropped due to Bitcoin reserve, thus Trump clarified only Bitcoin would receive active support.

- Meme coins like Dogecoin and Shiba Inu fell due to unconfirmed reserve inclusion.

- The crypto market dropped 4%, with uncertainty lingering ahead of the White House Crypto Summit.

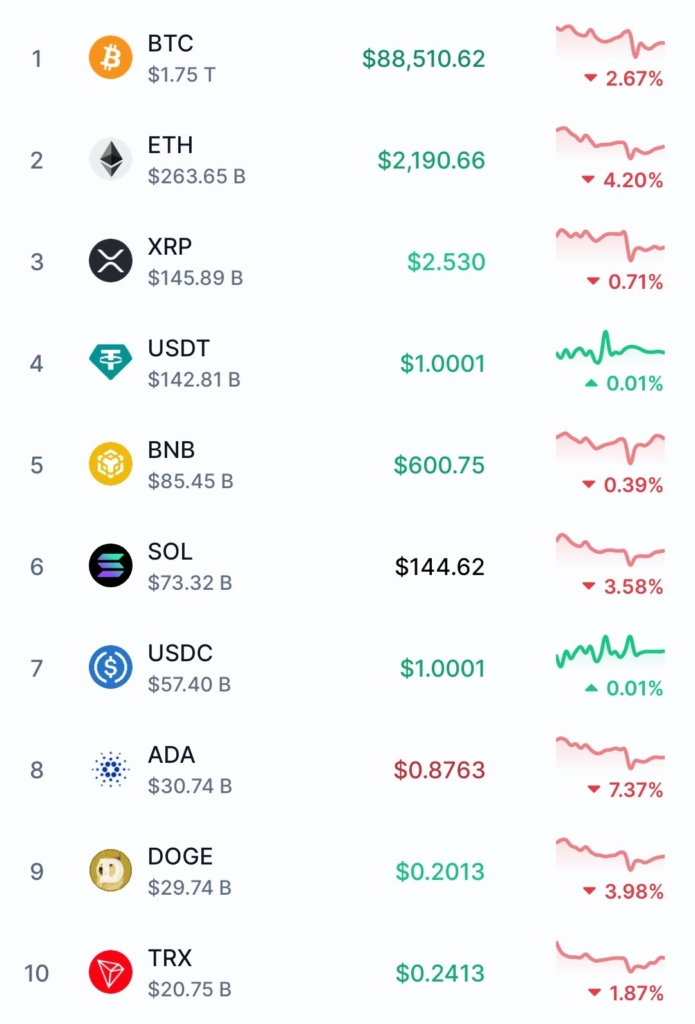

The crypto market has witnessed high volatility today, with top altcoins such as Ethereum (ETH), Solana (SOL), and XRP experiencing price drops. President Donald Trump’s recent executive order to create a Bitcoin strategic reserve first fueled hopes of a wider U.S. push into crypto. But these altcoins are falling as the market responds to conflicting signals.

XRP, Solana, and Cardano Dropped despite Bitcoin reserve

XRP, Solana, and Cardano enjoyed a brief burst of optimism after being included in Trump’s reserve plan . But the optimism did not last long after Trump made it clear. The government would actively support only Bitcoin, while other coins such as XRP, Solana, and Cardano. Would only be included in the reserve if governments confiscated them.

XRP dipped 2%, Solana lost 5%, and Cardano dipped 10%. This change suppressed investor sentiment and precipitated a sell-off, eliminating recent gains. The anticipation that the U.S. government would diversify its crypto reserves was dispelled, further fueling the downtrend in the market.

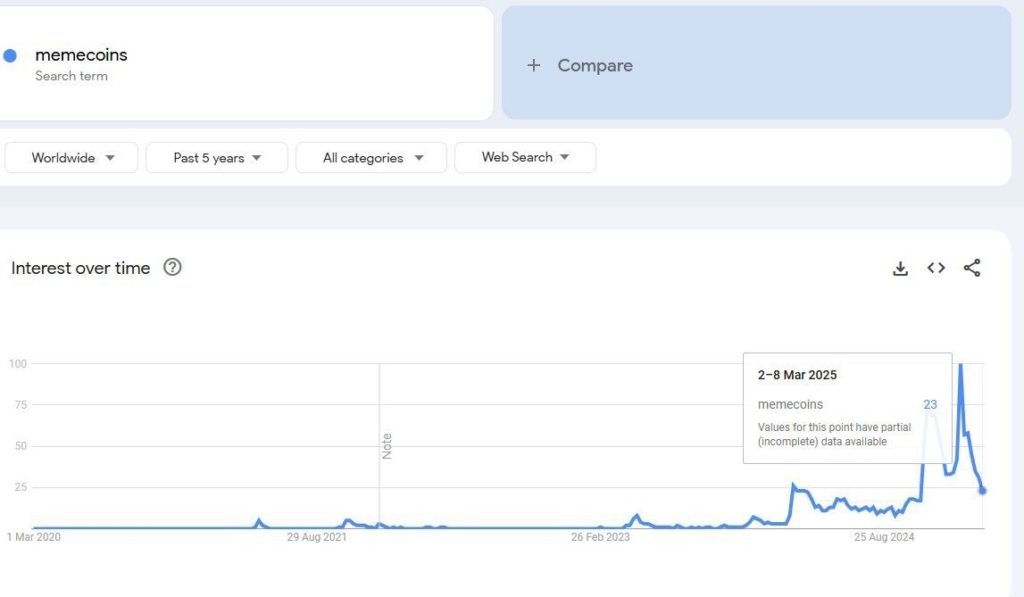

Meme Coins declined

Meme coins such as Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe Coin (PEPE) reflected the general market decline after bitcoin reserve announcement. DOGE declined 5%, SHIB fell by 2%, and PEPE lost 6%. Earlier this week, rumors had circulated that DOGE could be added to the reserve, triggering a brief price increase. But with no official support from Trump’s proposal, the gains were short-lived.

The overall crypto market experienced a drop of almost 4%, with the world’s market capitalization reducing to $2.88 trillion. The reserve’s under-diversification has instilled doubts in investors. Although the prices did fall, tokens such as MOVE, Sui, and Jito recorded some positive gains, yet the market is still bearish.

White House Crypto Summit

All eyes now shift to the White House Crypto Summit for possible policy updates that would give insight into the future of U.S. crypto rules. Investors are optimistic about a more open-minded approach, but hopes are low.

The market, meanwhile, will probably continue to suffer from uncertainty as traders readjust their strategies because of the volatile market atmosphere.

Trump’s Bitcoin reserve announcement was a step forward for the crypto space, the market remains volatile, and investor confidence in altcoins is wavering.

Highlighted Crypto News Today

4 Bullish Reasons Why Trump’s Bitcoin Reserve Is a Game Changer

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

IMX Gains Momentum with 300% Volume Surge

EU tells Spain to raise defense spending to 3% as Trump pressures NATO

Share link:In this post: The European Union is pushing its members, including Spain, to increase defense spending. European defense commissioner Andrius Kubilius urges Spain to spend 3% of their GDP on defense. Trump wants NATO allies to step up and contribute as much as 5% of their GDP to defense expenditures.

Warren Buffett to step down as Berkshire Hathaway CEO by year’s end, leaving Greg Abel in charge

Share link:In this post: Warren Buffett will step down as Berkshire Hathaway CEO by the end of 2025 and Greg Abel will take over. He said he will keep all his shares and stay involved, but Abel will make the final decisions. Warren also criticized President Trump’s trade policies, calling tariffs a global risk.

Berkshire shareholders reject all DEI and AI oversight proposals

Share link:In this post: Berkshire Hathaway’s shareholders recently turned down seven DEI and AI-related proposals. They claimed the proposals violated “the firm’s decentralized culture and were superfluous.” Corporate America’s shift from DEI initiatives accelerated during Trump’s second term in office.