- Bill Morgan challenges the claim that the rise of 36M+ altcoins has strengthened Bitcoin’s dominance.

- He argues that the distinction between Bitcoin and altcoins is artificial, pointing to Bitcoin forks like Bitcoin Cash.

- Jesse Myers boldly asserted that the altcoin season is “permanently cancelled.”

Crypto Lawyer, Bill Morgan, is now fighting claims from Bitcoin Advocate Jesse Myer that “altseason” has been cancelled.

The debate ignited when Myer shared a chart on X illustrating the rapid growth of altcoins since 2021. He argued that the sheer volume of tokens – over 36 million – had diluted their collective market strength, leaving Bitcoin as the dominant cryptocurrency.

What’s Myer’s Argument for Bitcoin Dominance?

“With 36,000,000+ altcoins, altseason has been permanently cancelled,” Myers wrote. He further argued that Bitcoin’s digital scarcity, network effects, and a so-called “Crypto Catch-22” mean it will remain unchallenged in the long run.

Myers explains Crypto Catch-22 as a paradox that many altcoins face. According to this theory, any altcoin that seeks to challenge Bitcoin must have a leadership team and a marketing budget to gain adoption. However, this very structure makes it centralized, unlike Bitcoin, which remains fully decentralized.

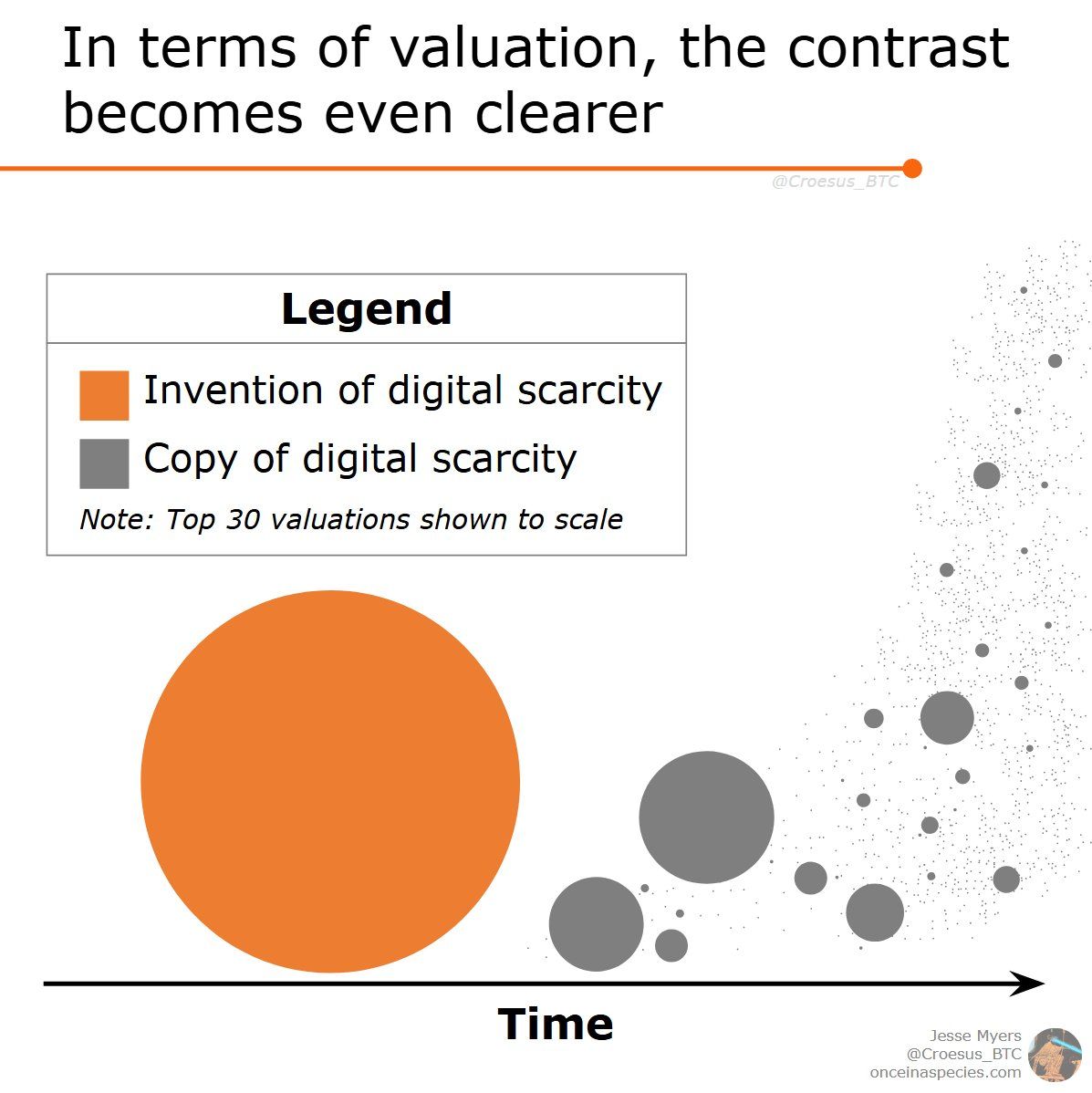

Myers also argues that Bitcoin’s dominance is stronger than it seems, comparing its valuation to the top 30 altcoins. His analysis depicts Bitcoin as the “invention of digital scarcity” with a massive circle. Meanwhile, he depicts altcoins, shown as smaller circles, as mere “copies,” suggesting that despite their numbers, altcoins don’t challenge Bitcoin’s market cap dominance.

Related: Altseason Incoming? Breakout Levels for Major Altcoin Rally — Analyst

How Did Bill Morgan Counter?

Morgan dismissed this reasoning as biased. He pointed out that Bitcoin itself is not immune to fragmentation, referencing Bitcoin Cash (BCH) as an example of how Bitcoin, too, has experienced forks.

“That misguided logic imports an artificial distinction between altcoins and Bitcoin in favor of Bitcoin,” Morgan responded.

What’s the Current State of Bitcoin Dominance?

Per CoinMarketCap, Bitcoin holds a 60.8% dominance in the crypto market. Ethereum trails with an 8.5% dominance while other altcoins collectively account for 30.7%.

Historical trends show Bitcoin’s dominance increasing from 60.0% last month. This aligns with Myers’ argument that altcoins continue to weaken in aggregate market share.

Related: Bitcoin Dominance Surges Past 60% Threshold, Signaling Potential Crypto Market Shift and Altcoin Pressure, Analyst Warns

Do Altcoins Still Have a Future?

While Bitcoin’s market dominance has risen since 2021, altcoins continue to innovate, offering functionalities that Bitcoin does not. Ethereum, Solana, and other blockchain networks have developed ecosystems that challenge the idea of Bitcoin as the only relevant cryptocurrency.

However, Myers’ perspective suggests that most altcoins are highly illiquid, with their market caps inflated by dead or dying projects. His chart indicates that when adjusted for this factor, Bitcoin’s real dominance could be even higher than the reported numbers suggest. The debate, it seems, is far from over.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.