Ethereum Price Prediction: Will ETH Price Crash below $1K Ahead of the FOMC Meeting?

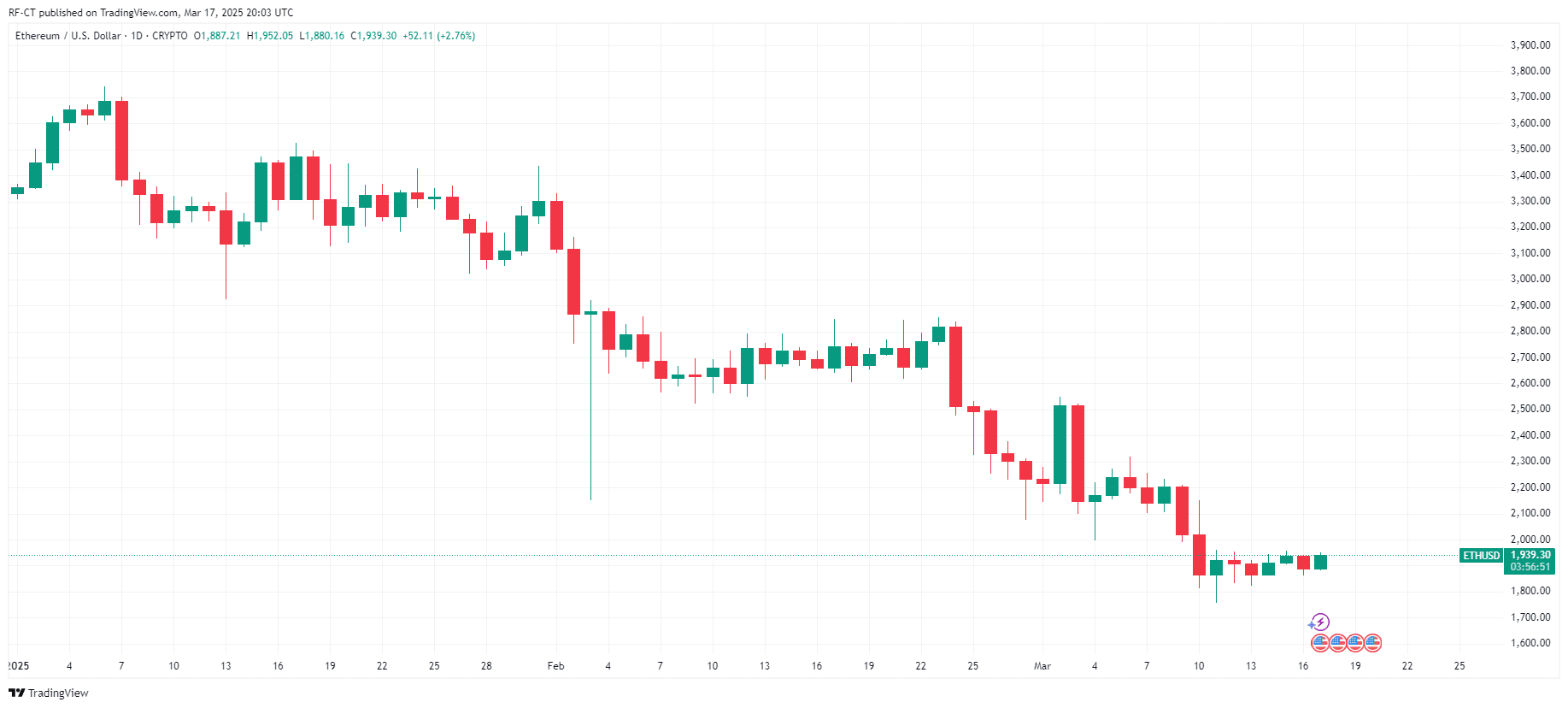

As of today, Ethereum price is trading at approximately $1,900 , reflecting a slight increase over the past 24 hours. With the highly anticipated FOMC meeting happening in 2 days, Ethereum's price could experience significant volatility. Will the Federal Reserve's decision push ETH below $1,000, or will it sustain current levels? Here's an Ethereum price prediction on what to expect.

Ethereum Price Prediction Ahead of the FOMC Meeting

1- Current Ethereum Price Trends

Ethereum's network activity has been on a decline, with daily active addresses and new wallet creations hitting yearly lows. This decrease in on-chain engagement has led to reduced transaction fees and increased inflationary pressures, adding to bearish sentiment in the market.

Analysts warn that if Ethereum's price dips below the $1,900 support level , it could trigger liquidation from long-term holders, accelerating further price declines. The critical support range between $1,900 and $1,843 is under close watch, especially as the FOMC meeting looms. The outcome of this meeting could dictate whether Ethereum maintains its position or faces a steep decline.

By TradingView - ETHUSD_2025-03-17 (YTD)

By TradingView - ETHUSD_2025-03-17 (YTD)

2- FOMC Meeting's Potential Impact on Ethereum Price

The Federal Open Market Committee (FOMC) meeting is expected to deliver key insights into U.S. monetary policy, particularly concerning interest rates and inflation control. A hawkish stance could strengthen the U.S. dollar, leading to downward pressure on risk assets like Ethereum. Conversely, a dovish approach might ease market fears, allowing ETH to hold or even recover .

Market participants are closely watching the Federal Reserve's tone, as stricter policies could lead to broader crypto market corrections. Ethereum's price movement in the coming days will heavily depend on these macroeconomic signals.

3- Revised Ethereum Price Prediction

Standard Chartered recently revised its Ethereum price target for 2025 from $10,000 to $4,000, citing increased competition from Layer-2 solutions like Coinbase's Base. However, these predictions could shift dramatically based on the upcoming FOMC decision. If stricter policies are announced, bearish scenarios could dominate, potentially pushing ETH toward lower support levels.

Will ETH Price Crash below $1K?

Ethereum's price is at a pivotal point . The upcoming FOMC meeting could determine whether ETH sustains its price above the $1,900 mark or risks a deeper fall. If bearish sentiment prevails post-meeting, Ethereum could test lower supports, raising concerns of a potential drop below $1,000. However, a favorable outcome could strengthen investor confidence and keep ETH above critical levels.

Investors are advised to stay cautious and closely monitor the FOMC's announcements and Ethereum's subsequent price reactions. Technical levels and macroeconomic signals will be key in determining ETH's short-term trajectory.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoins flipped the script to surpass Visa in transaction volume

Share link:In this post: Bitwise Crypto Market Review for Q1 2025 revealed that stablecoin transactions narrowly surpassed Visa’s payments. Stablecoin transaction volume rose by over 30%, and the market’s AUM hit an all-time high of over $218 billion, with a 13.5% increase quarter-over-quarter. Visa and Bridge announced a partnership to offer stablecoin-linked Visa cards to customers across multiple countries in Latin America.

Bitcoin nears $100K as $61.6B support zone strengthens around $95K

Ethereum active addresses surpass 15M as Buterin sets 2025 goals

Strategy stock closes April with 32% surge