$500M BTC short-seller closes HyperLiquid trade, Eyes Melania

The mystery HyperLiquid trader continues to gain attention from others. The whale has closed the $524 million BTC short that shook the market and has set eyes on MELANIA coin.

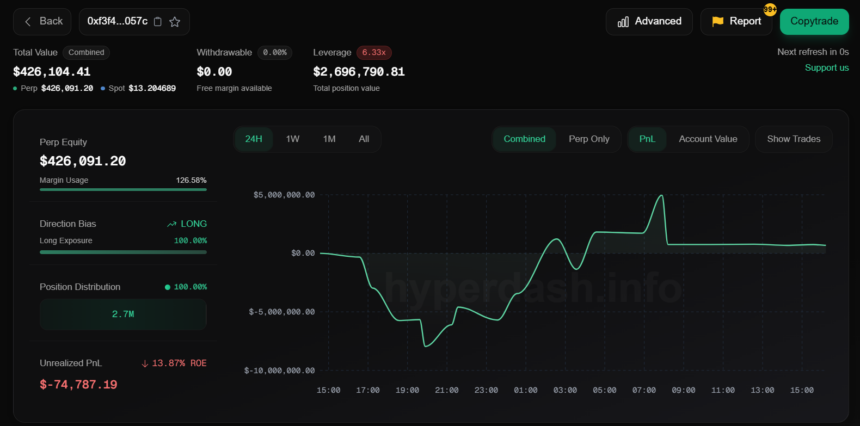

The trader has made a huge $2.73 million bet on MELANIA. They went long with 5x leverage, hoping the price would go up, but things are not looking great.

According to Hyperdash, they bought in at $0.7307 to $0.7363, but the price dropped to $0.7079, leaving them down by $74,787 in unrealized losses. If it hits $0.6531, they’ll be completely liquidated.

They initially put up $546,929.73 of their own money and even paid an extra $931.39 in fees just to keep the trade open.

The trader’s positions and current value | Source: HyperDash

The trader’s positions and current value | Source: HyperDash

This trader has a history of making massive leveraged bets, sometimes winning big and other times getting dangerously close to losing everything.

A while back, they placed a $333.9 million Bitcoin short with 40x leverage, entering at $84,040.80. That trade didn’t go well either as Bitcoin moved up slightly, and they were instantly down $1 million.

Before that, they pulled off an insane 50x Ethereum long that made them $1.8 million, but it wiped $4 million from Hyperliquid’s HLP Vault. That move even forced the platform to change its rules, lowering leverage limits and increasing margin requirements.

Then, just recently, they made headlines again by going $524 million short on Bitcoin . At first, the position was $430 million, but they added $100 million more, bringing their total bet to $524 million at 40x leverage. Their liquidation price was $85,565, and Bitcoin was dangerously close to hitting it.

Now, with this new MELANIA long, the trader is back in risky moves. However, the trader did not buy all at once, but stacked up each position in chunks from anywhere from 4,823 to 44,156 tokens at a time. All this happened in just a few minutes, and each buy had a small USDC fee attached.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Samsung challenges $520M India tax demand, joins Volkswagen in rejecting penalties

Share link:In this post: Samsung is contesting a $520 million tax demand from Indian authorities for allegedly misclassifying imports of networking equipment. The company has filed a 281-page challenge at the Customs Excise and Service Tax Appellate Tribunal in Mumbai, claiming that similar practices by Reliance Jio went unchallenged. The case follows a similar dispute involving Volkswagen, which is also contesting a $1.4 billion tax demand for misclassified imports.

Ethereum Price Prediction: Will ETH Break Out From the $1,800 Zone?

Dogecoin Price Prediction: Is DOGE Getting Ready for a Breakout Above $0.20?

Ethereum Price Outperforms BTC as Blockstream CEO, Adam Back Reacts to Vitalik’s Latest Proposal