Metaplanet acquires another 696 bitcoin for $67.9 million, increasing its total holdings to 4,046 BTC

Quick Take Metaplanet has announced the acquisition of a further 696 BTC for approximately 10.152 billion yen ($67.9 million) at an average price of 14,586,230 yen ($97,512) per bitcoin. The purchases were executed through the assignment of previously sold cash-secured put options, bringing the company’s total holdings to 4,046 BTC ($340 million).

Japanese investment firm Metaplanet announced the acquisition of a further 696 BTC on Tuesday, alongside the Q1 results of its bitcoin income generation business line.

The latest acquisitions were executed through the assignment of previously sold cash-secured put options at an average purchase price of 14,586,230 yen ($97,512) per bitcoin for a total cost of 10.152 billion yen ($67.9 million).

Metaplanet's bitcoin income generation business earns money by selling cash-secured bitcoin put options each quarter, enabling the company to collect premiums in bitcoin while setting aside capital to buy more if the options are exercised. In Q1, the company earned 770.35 million yen ($5.2 million) in operating revenue by executing this program — 11.4% up quarter-over-quarter and more than 25% of Metaplanet's annual target of 3 billion yen ($20 million). These options were written at the beginning of the quarter, during a period of higher market prices. Of this latest set of bitcoin purchases, 645.74 BTC were acquired via options exercise and 50.26 BTC from the options premium received.

A cash-secured put option is a financial strategy where an investor sells a put option and sets aside enough cash to buy the underlying asset — in this case, bitcoin — if the option is exercised. The seller of the put option agrees to buy the asset at a specific price (the strike price) if the buyer chooses to exercise the option. The strategy can generate income from the premium received for selling the option, while also potentially acquiring the asset at a lower price if the market price drops. Unfortunately for Metaplanet, in this case, bitcoin's price has fallen since the put options were sold and currently trades for around $84,214, according to The Block's Bitcoin price page .

However, the company deployed just 9.386 billion yen ($62.7 million) in collateral, arguing it acquired more bitcoin than would have been possible via direct spot market purchases using this strategy. "While the nominal book cost reflects an average acquisition price of 14,586,230 yen [$97,512] per bitcoin, the effective cost, net of premiums earned, was 13,479,404 yen [$90,073] per bitcoin — below the prevailing market price at the time the strategy was initiated," the Tokyo-listed firm said in the statement, indicating it would have otherwise purchased bitcoin at market prices in early January when bitcoin was chasing the $100,000 level.

Top 10 corporate bitcoin holder

Metaplanet now holds a total of 4,046 BTC — currently worth approximately $340 million — placing it in the top ten of known corporate bitcoin holders alongside Michael Saylor's Strategy , Bitcoin miner MARA , Elon Musk's Tesla and Jock Dorsey's Block , according to The Block's data dashboard .

Like those firms, Metaplanet uses a key performance indicator known as BTC Yield to assess the effectiveness of its bitcoin acquisition strategy in driving shareholder value. BTC Yield represents the percentage change period-to-period of the ratio between Metaplanet's total bitcoin holdings and its fully diluted shares outstanding. Year-to-date, the firm said it has achieved a BTC Yield of 95.6%, according to CEO Simon Gerovich.

Metaplanet has been actively buying the world's largest cryptocurrency since it introduced its bitcoin adoption strategy in April 2024. The company aims to hold 10,000 BTC by the end of 2025 and 21,000 BTC by the end of 2026.

Last week, Metaplanet announced it had market-bought an additional 150 BTC ($12.6 million) just a few days after it appointed Eric Trump to Strategic Board of Advisors, acquired at around $83,801 per bitcoin. On Monday, Metaplanet issued 2 billion yen ($13.3 million) worth of zero-interest bonds to fund further bitcoin acquisitions following a meeting of its board of directors.

Metaplanet's stock closed up 2% on Tuesday at 409 yen ($2.73), according to TradingView, having gained more than 1,950% over the past year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

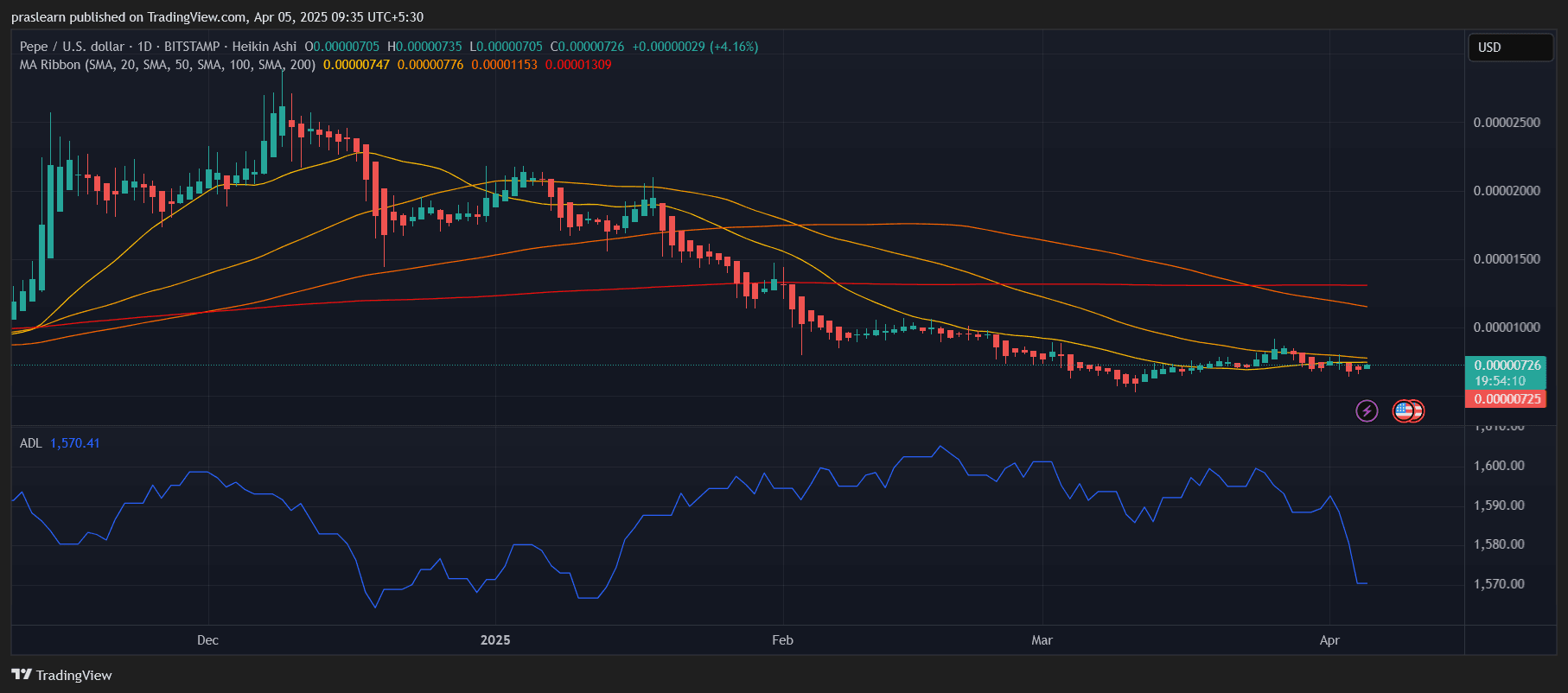

PEPE Price Poised for a Massive Rally?

Is Pi Network Headed to Zero? Price Crashes to New Low Below $0.60

Pi Network has suffered from a lack of trust in its project, as well as from a relative absence of big-name listings.

SUI Price Pops as Falling Wedge Breaks – Here’s What Happens Next

Sui has enjoyed considerable growth as a network in recent months, yet the market-wide downturn could mean that it underperforms for a while yet.

Ethereum Developers to Launch Pectra Upgrade Mainnet on May 7

As Ethereum looks to integrate institutional accessibility and scalability tech, the Pectra upgrade shows a strategic pivot in the blockchain’s battle to regain market dominance.