USDC Issuer Circle Files for $5 Billion IPO to List on NYSE

Circle, the issuer of USDC stablecoin, files to go public in late April on the NYSE under the ticker CRCL.

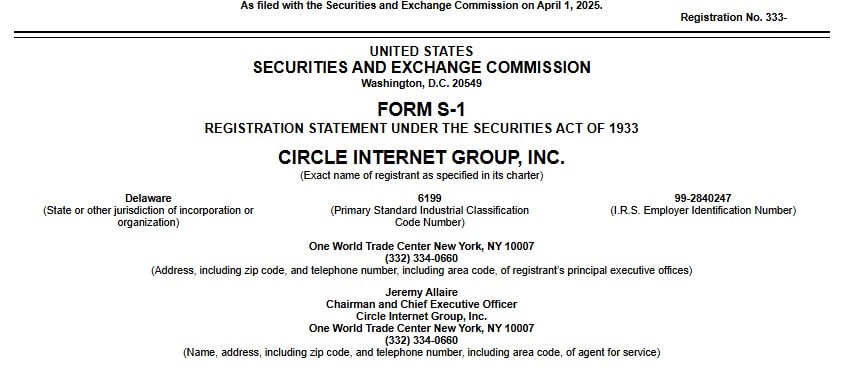

Circle, the company behind USDC, has officially filed for an IPO, aiming to list on the New York Stock Exchange under the ticker symbol CRCL. The company is targeting a valuation of up to $5 billion, with JPMorgan Chase and Citigroup acting as lead underwriters.

This is Circle’s second attempt to go public after the firm failed to merge with a special purpose acquisition company (SPAC) in 2022 due to regulatory issues. The revenue of Circle in the year 2024 was $1.68 billion, which is higher than the previous years. Its net income, however, was $156 million, a decline from $268 million in the prior year 2023.

Source: US Securities and Exchange Commission

Source: US Securities and Exchange Commission

An IPO would place Circle among the largest crypto firms to list in the U.S., only after Coinbase that went public in 2021 with a market capitalization of about $44 billion.

Circle is most famous for offering USD Coin (USDC), the second largest stablecoin in the market with approximately $60 billion in circulation. The growing stablecoin market is evident by Circle’s decision to go public, which shows that cryptocurrency companies are becoming more involved in traditional finance.

The stablecoin market is on the rise as stablecoin legislation in the United States is expected to be passed later this year. Circle’s IPO may disrupt the crypto exchange market, especially with the help of its cooperation with Coinbase, which splits the USDC revenue.

With stablecoins becoming more involved in crypto trading, Circle’s IPO may be a landmark event for the industry.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Clings to $74K: Analyzing BTC’s Ability to Ward Off Further Decline

Stability at $74K: How 50,000 BTC Holders are Supporting Bitcoin's Resistance Against Further Dips

Donald Trump’s Memecoin to Face $320 Million Token Unlock as Price Dips

33% of French looking to buy crypto in 2025 but Italians are even more bullish

Share link:In this post: A third of French people intend to purchase cryptocurrencies this year. New study shows Italians as most bullish among surveyed nations in Europe. The crypto sector’s growing legitimacy helps attract more investors, researchers say.

Spanish Police End Crypto Scam Ring That Used AI to Swipe $21 Million From Investors