LaunchLab vs. Pump.fun: Solana’s Meme Coin Factory Sparks Fresh Rivalry in Token Creation

Raydium LaunchLab made a splash with its meme coin debut, but Pump.fun still leads the race—will innovation close the gap?

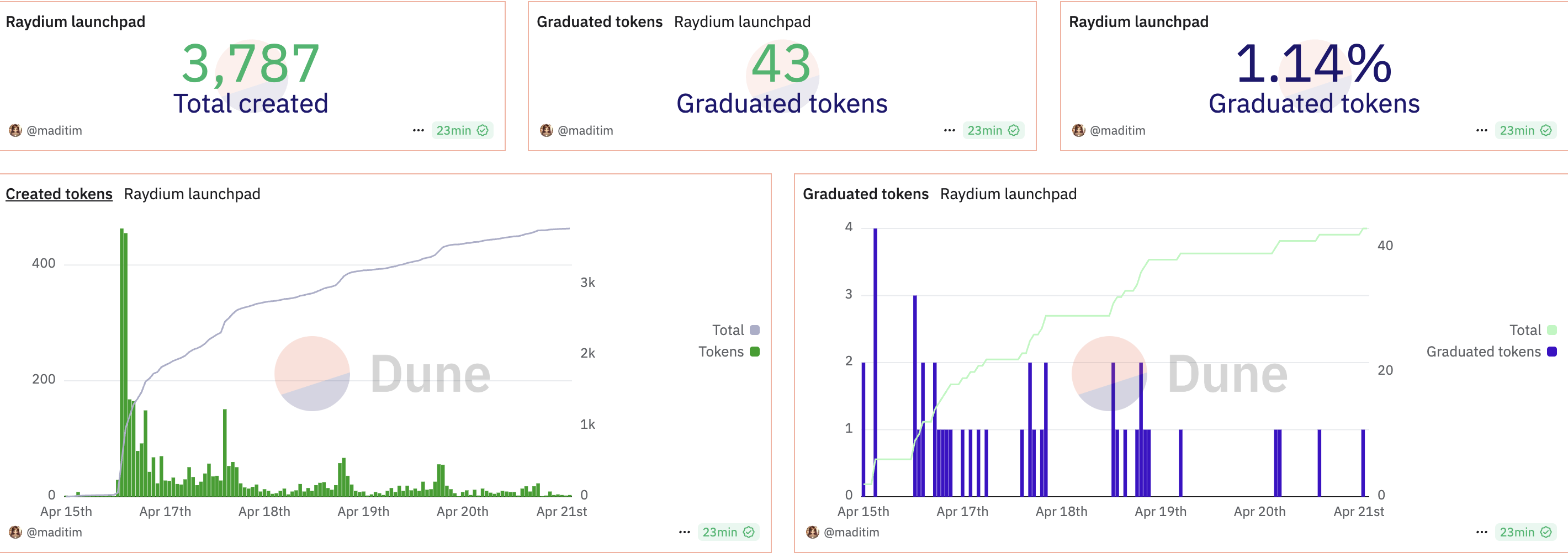

Raydium launched its LaunchLab on April 17, 2025. Within five days, Raydium LaunchLab generated 3,787 tokens, achieving a “graduated rate” of 1.14%.

This article analyzes Raydium LaunchLab’s performance, compares it with competitors, and provides a comprehensive overview of the ongoing meme coin launchpad war.

Impressive Start but yet to Outshine Pump.fun

Raydium, a prominent project within the Solana ecosystem, introduced its LaunchLab meme coin launchpad, which aims to directly challenge Pump.fun.

According to Dune data, Raydium LaunchLab created 3,787 tokens in its first week, achieving a “graduation rate” of 1.14%. This rate is based on the number of tokens reaching a threshold of 85 SOL (approximately $11,150) to transition to trading on Raydium’s Automated Market Maker (AMM).

Performance of Raydium LaunchLabs. Source:

Dune

Performance of Raydium LaunchLabs. Source:

Dune

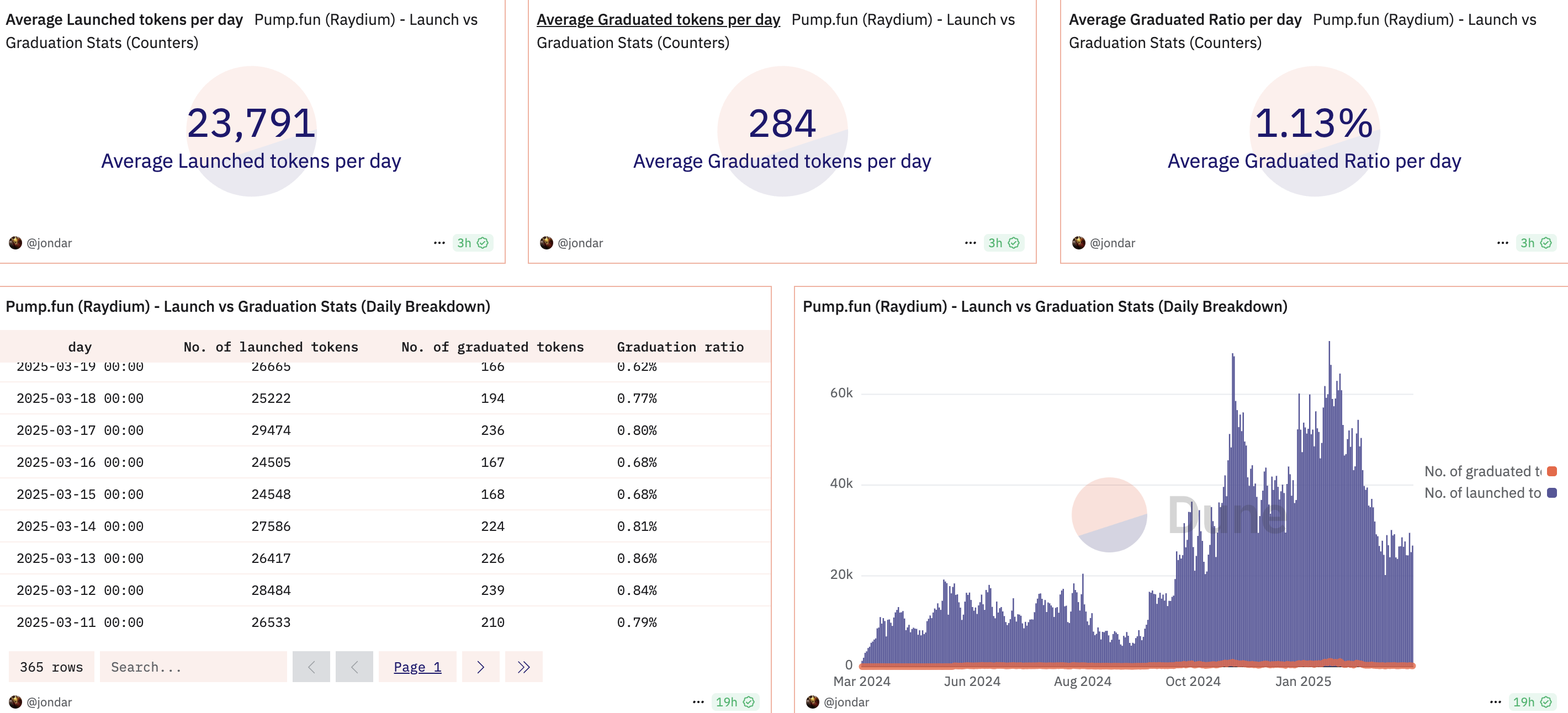

While these figures reflect a promising debut, Raydium LaunchLab still trails behind Pump.fun. The pioneering Solana-based platform, Pump.fun, boasts an average daily graduation rate of 1.13%—slightly lower than LaunchLab’s.

Performance of Pump.fun. Source:

Dune

Performance of Pump.fun. Source:

Dune

Moreover, Pump.fun has had a longer runway to build its community and refine its processes, and created over 600,000 tokens in January 2025. This shows Pump.fun’s continued dominance, even as Raydium LaunchLab exerts significant competitive pressure.

Meme Coin Launchpad War

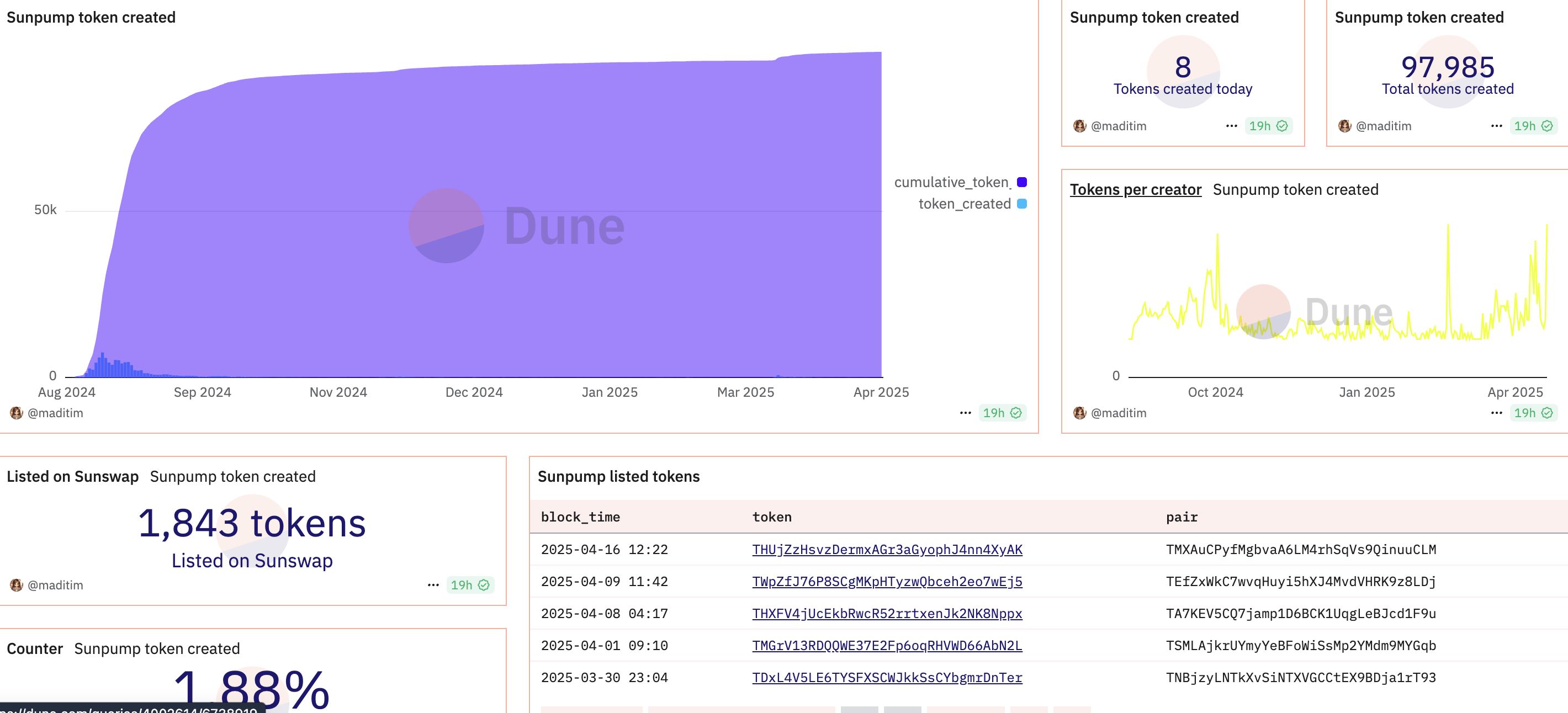

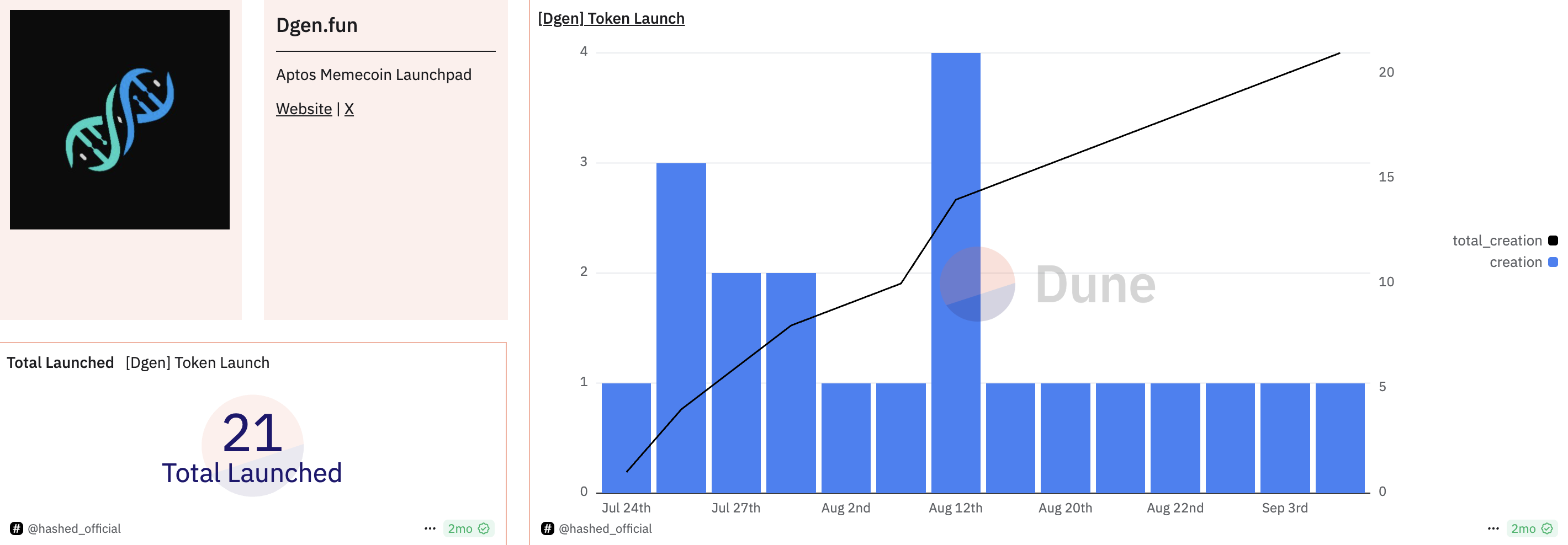

Beyond Raydium LaunchLab and Pump.fun, the meme coin launchpad war includes other platforms like SunPump (Tron), Dgen.fun (Aptos), or Auto.fun. However, their performance remains modest.

Performance of SunPump. Source:

Dune

Performance of SunPump. Source:

Dune

Per Dune Analytics, SunPump has created only eight tokens today, while Dgen.fun has generated 21. These numbers indicate that neither platform can yet compete with Raydium LaunchLab or Pump.fun’s scale.

Performance of Dgen.fun. Source:

Dune

Performance of Dgen.fun. Source:

Dune

Despite backing from Justin Sun and the Tron ecosystem, SunPump struggles to attract users. This may partly stem from Tron’s weaker appeal to the meme coin community than Solana. Similarly, Dgen.fun has yet to make a significant impact, likely due to Aptos being a relatively new blockchain with a smaller community to drive meme coin development.

Key Factors Behind LaunchLab’s Appeal

Raydium LaunchLab boasts several competitive advantages. First, the platform allows free token creation, offering features like customizable bonding curves and no migration fees. Once a token reaches the 85 SOL threshold, it automatically transitions to Raydium’s AMM, ensuring immediate liquidity.

Additionally, Raydium imposes a 1% transaction fee, of which 25% is allocated to buy back RAY tokens—a move designed to boost the value of its native token.

Following the LaunchLab announcement, RAY’s price surged nearly 15%, reaching $2.41 before settling at $2.21. This reflects strong community optimism about LaunchLab’s potential. However, to surpass Pump.fun, Raydium must improve its graduation rate and attract more users, particularly as Pump.fun has built credibility with its simple, transparent mechanism.

The meme coin launchpad war is not solely about the number of tokens created—it’s a battle of technology, community, and sustainability. Pump.fun remains the leader, thanks to its first-mover advantage and massive scale. However, Raydium LaunchLab is emerging as a formidable contender, backed by the Solana ecosystem, renowned for its fast transaction speeds and low costs.

As the competition intensifies, Raydium LaunchLab’s ability to innovate and grow its user base will be critical in challenging Pump.fun’s dominance in the meme coin launchpad arena.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Strategy reports $4.2B loss but aims to raise $21B to buy more Bitcoin

Tether’s U.S. Treasury holding approaches record high of $120B

Share link:In this post: Today, Tether published its Q1 2025 attestation report prepared by BDO, confirming total exposure in U.S. Treasuries approaching $120B. Tether also reported over $1B in operating profit from traditional investments during the quarter, driven by solid performance in its U.S. Treasury portfolio. The milestones reinforced the company’s conservative reserve management strategy and highlighted its growing role in distributing dollar-backed liquidity at scale.

Automakers like Ford in solid April sales driven by panic buying amid tariff worries

Share link:In this post: Consumers rushed to buy vehicles on fears of potential price hikes due to the Trump tariffs. While there was strong demand which started in March, this started to wane towards the end of April. For Ford, it reported a 16% sales increase in April.

Arbitrum offers as much as $100k per report to snitch on wasteful DAOs

Share link:In this post: Arbitrum is offering up to $100,000 in ARB tokens to community members who report DAO grant misuse. The “Watchdog” program encourages confidential whistleblowing via the open-source platform, GlobaLeaks. Severity of violations determines the reward, with a funding cap of 400,000 ARB.